The Real Reason You’re Paying Taxes on Fake Profits

Why the System Taxes You for Losing Money

Today I want to explain a “tax tip” that isn’t really a tax tip, but rather an uncomfortable revelation. Something that, once you truly understand it, makes you realize we don’t live in a fair economic system, but inside a perfectly legalized fiscal trap. And the worst part is that almost no one notices.

It all starts with a simple observation: when you sell an asset: a house, a stock, anything the State charges you taxes on the “capital gain.” They tell you you’ve made money, that you’ve done well, that it’s time to pay your fair share. But what they never tell you is that this gain isn’t real. It’s an accounting illusion.

Imagine something simple. You buy a house in 2020 for 200,000 euros. Four years later you sell it for 250,000. On paper, you’ve made a 25% profit. Fantastic. But wait. During that same period, prices have risen by roughly 25%. Inflation has destroyed the purchasing power of the money you originally paid. In real terms, you’ve gained nothing. In fact, if you include taxes, transaction costs, and opportunity cost, you’ve probably lost.

Yet you’ll still pay taxes as if you had gained.

The system treats you like a lucky speculator when in truth you were just trying to protect yourself from the silent tax called inflation. That’s the irony. Not only does the system fail to protect you from losing purchasing power, it punishes you for trying to defend yourself.

The trap is subtle. The purchase price you use to calculate your capital gain is expressed in monetary units that no longer have the same value. It’s as if you bought with solid euros and sold with diluted ones. But the State ignores that difference. It taxes you on a nominal gain, not a real one. It’s the tax on the mirage.

If we wanted to do it fairly, we would have to adjust the purchase price to accumulated inflation. Let’s use a simple example:

Initial price: €200,000

Year of purchase: 2020

Year of sale: 2024

Sale price: €250,000

Accumulated inflation (2020–2024): 25%

Inflation-adjusted purchase price: €200,000 × 1.25 = €250,000

Real gain: €0

But the system ignores this correction. It declares that you’ve made €50,000 and demands you pay tax on that “profit.” That gap between nominal and real value is the greatest legalized theft of our time.

And the worst part is, it doesn’t just happen with real estate. It happens with everything. Stocks, land, bonds, family businesses. The tax system rests on a false premise: that money is stable. But money no longer measures value; it only reflects how quickly it’s being devalued.

That’s why I insist this isn’t a fiscal trick but a structural fact. Inflation is the accounting illusion that justifies the hidden confiscation of productive savings.

Most people accept it because they never stop to think about it. “That’s just how it works,” they say. And meanwhile, the State collects, the banks profit from cheap credit, and the average citizen believes they’re getting richer because their home price in euros is going up… when in reality, only the number is going up, not the value.

True value is measured in purchasing power, not in nominal figures. And by that measure, almost no one wins.

That’s why when someone tells me they sold a property “for a profit,” my first question is always: profit relative to what? To the euros of then, or to the euros of now? If you compare in units of purchasing power, most of the supposed returns from the last cycle are neutral or negative. And yet, the system taxes you as if you had succeeded.

That’s the trap that keeps most people stuck. Winning in appearance, losing in reality. And every time you sell, you pay another toll. That’s why true long-term investors don’t sell. Not out of dogma, but because selling is an act of fiscal self-harm.

It may sound exaggerated, but let’s look back. Someone who bought a house in 1980 for €10,000 and sells it today for €100,000 will be told by the tax office that they’ve made €90,000. They’ll pay taxes on that amount. But if we adjust those €10,000 for cumulative inflation, they’d be roughly €95,000 today. In real terms, they’ve lost purchasing power. Yet the system punishes them anyway.

Multiply that by millions of transactions, and you understand we’re looking at a massive transfer of wealth from savers and producers to the State apparatus.

The practical conclusion is clear: the longer you hold a productive asset, the more it protects you from silent confiscation. Not just because it accumulates value, but because you avoid paying taxes on an illusory gain. The only real “tax shelter” today is not realizing the gain. Buy, hold, die.

But even more important than the strategy is the awareness. Understanding that modern money is no longer a stable measure of value. That your balance sheets in euros don’t tell the full story. That your real return depends on how purchasing power moves, not on nominal prices.

So when you hear someone say that inflation is good or that capital gains taxes are “fair,” remember this: if the calculation base is inflated, the entire system is built on a lie.

What looks like progress is just inflation with good marketing.

And until we understand that, we’ll keep thinking we’re winning money in a game designed for us to lose.

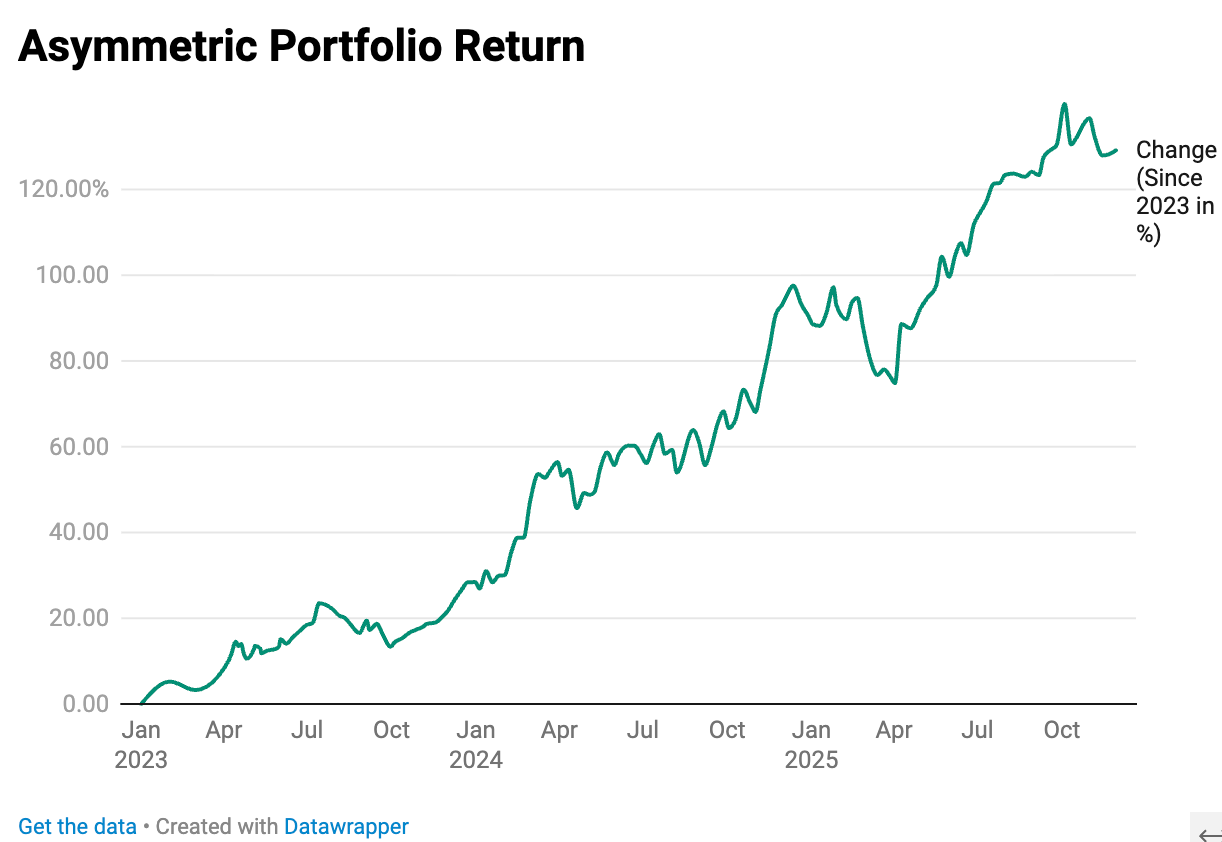

NOW OUR PORTFOLIO…