The True Cost of Trillions in Debt

The Hidden Transformation: What They're Not Telling You About the Global Economy

The global economic system is undergoing an unprecedented transformation. A few weeks ago, we discussed how every dollar entering the market does not contribute as much value as it historically did.

This means that more money generally does not result in more development.

A few days ago, we witnessed one of the largest surges of money into the markets in just one day. This increase was $275B added to the debt IN JUST ONE DAY. Not only that, the rise exceeded $1T of the national debt in a single month.

This is a problem not only faced by the US but by the global economy as a whole.

Another major issue this surge in debt brings is that we cannot repay all this debt we are issuing. In fact, the United States hasn't produced a surplus in over 20 years. This means more money is being spent than is generated by the GDP.

In any business worldwide, this would result in a permanent shutdown, and sooner or later, the same will happen to nations.

Last year, the GDP was nearly $5T, while debt spending exceeded $6T. One of the largest deficits of the 21st century.

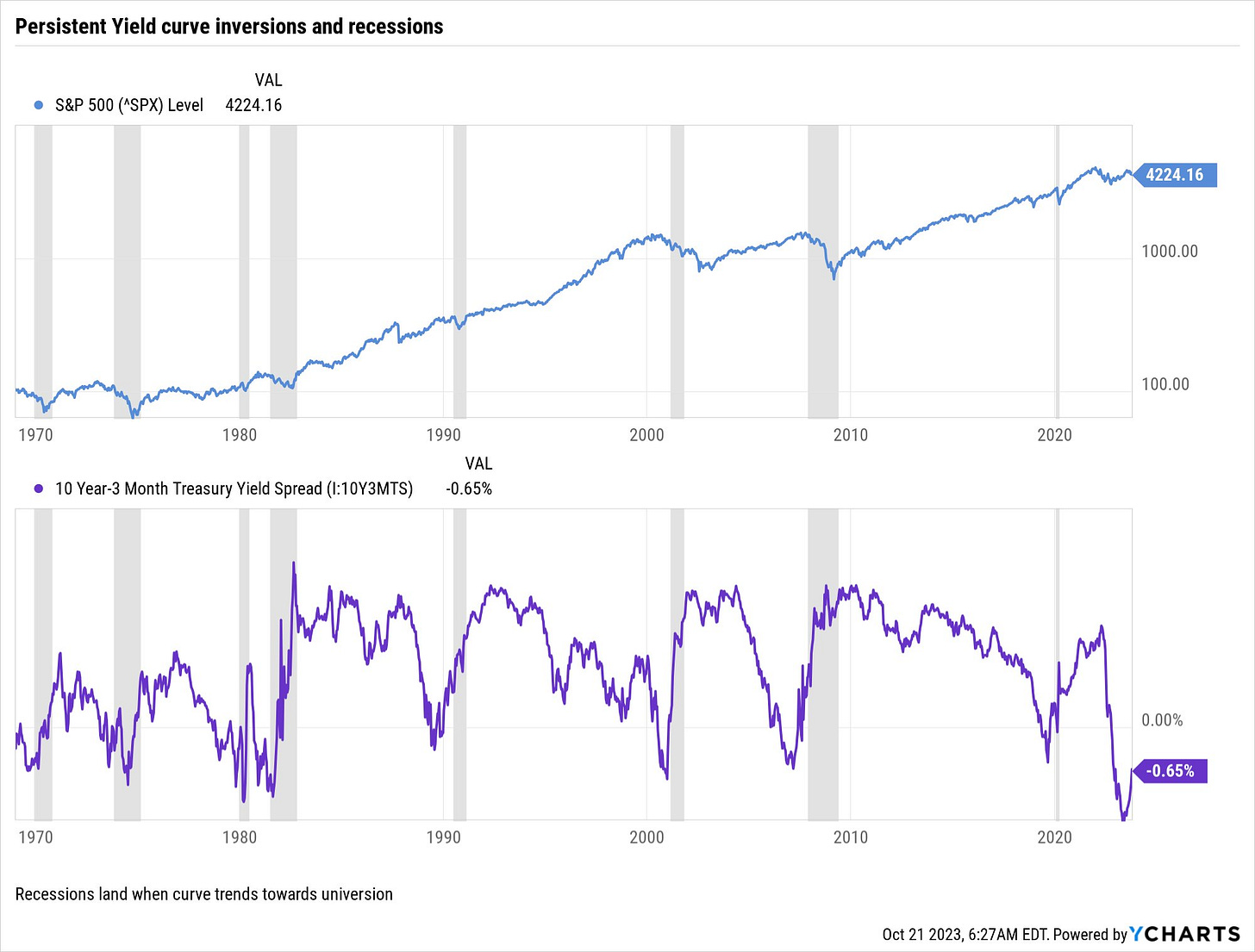

We've noticed this problem for many years, and it has intensified lately where we believe an unprecedented recession is looming.

How is it possible that all investors prefer short-term deposits over stocks? That's precisely what's happening now. Every time this has occurred, it has led to a crisis.

These crises have always been greater, the more dispersed this curve was.

The Power of Central Banks

We've talked endlessly about the immense power central banks hold over the economy. They are responsible for absolutely everything that happens. When they raise interest rates, they benefit certain companies; when they lower them, they benefit others.

When they print money, indices rise.

When they stop printing, indices fall.

...

It has reached a point where even congress members are realizing the situation:

"I've done many challenging things being a woman standing alone, often facing long hours and personal sacrifices. But there's a limit to human capacity. If Congress doesn't pass a debt commission this year to address the overwhelming national debt and inflation, at least by the next debt ceiling increase at the end of 2024, I won't continue sacrificing my children for this circus with a complete absence of leadership, vision, and determination. I can't save this Republic on my own."

Frankly, I believe this woman will resign from Congress because it's impossible to maintain this rate of printing, especially when economically supporting two wars.

One of the most significant hyperinflations in history was in Germany, occurring right after the war. So much money was invested in armament and later in rebuilding everything destroyed, resulting in hyperinflation where the price of a coffee would increase as you were drinking it.