This is NOT a Normal Newsletter. You Must Read It

Inflation's Unexpected Turn

Let's discuss something that happened last week: the rebound in the Consumer Price Index (CPI). Last Tuesday, an event of significant importance occurred, one that warrants close monitoring. Yes, I'm referring to inflation, which has taken a surprisingly negative turn by exceeding expectations.

Where an intermonthly rebound of +0.2% between December 2023 and January of this year was anticipated, the actual increase was +0.3%. Similarly, while it was expected that the annual inflation rate would drop to +2.9%, it instead fell to an unexpected +3.1%.

However, what has alarmed the market is not merely this unexpected surge but how it occurred and, more importantly, because it raises doubts about whether inflation will begin to accelerate from here on out. This scenario could force the Federal Reserve to keep interest rates high or even raise them further, likely having a negative impact on the stock market, which had been rising for months in anticipation of official interest rate cuts starting in the spring.

Adding to our concerns, another piece of data has negatively startled us: the ISM figure. This data shows growth and that activity is picking up pace, but what's particularly interesting is the sub-data on inflation, which has seen a significant acceleration (see chart). Indeed, this data from the ISM institute tends to exceptionally reflect the dominant trend of the official inflation figure, often with a few months' lead time.

But the real surprise didn't come from the general inflation data. After all, a figure being a tenth worse than expected is irrelevant as such discrepancies are commonplace in macroeconomic data.

The issue arises from the slight acceleration in the US economic activity, where inflation in the services sector is exploding higher.

These two pieces of data confirm that the decline in inflation might have ended. And do you know what happens then? If not, you should look at what happened at the end of 2021 when the CPI began to rise again.

This is not an isolated event; similar patterns have occurred throughout history, with inflation spikes not being one-offs but occurring multiple times. The clearest example, and here's the crucial part, is during the 1970s.

I would advise you to pay close attention to the following chart:

As inflation rises, markets tend to fall. Just as markets bottom out when inflation peaks – we've previously advised buying at these points – now, the opposite is happening.

This was the scenario when we told you that inflation had reached its peak.

We urge you to exercise great caution. The main problem facing the economy is that, although inflation has decreased, interest rates have not. If a rebound occurs, the Federal Reserve and central banks might have no choice but to increase rates instead of lowering them (as promised).

This could lead to a significant crisis, potentially larger than the one seen in 2007, since when markets began to fall back then, interest rates were lower than they are today.

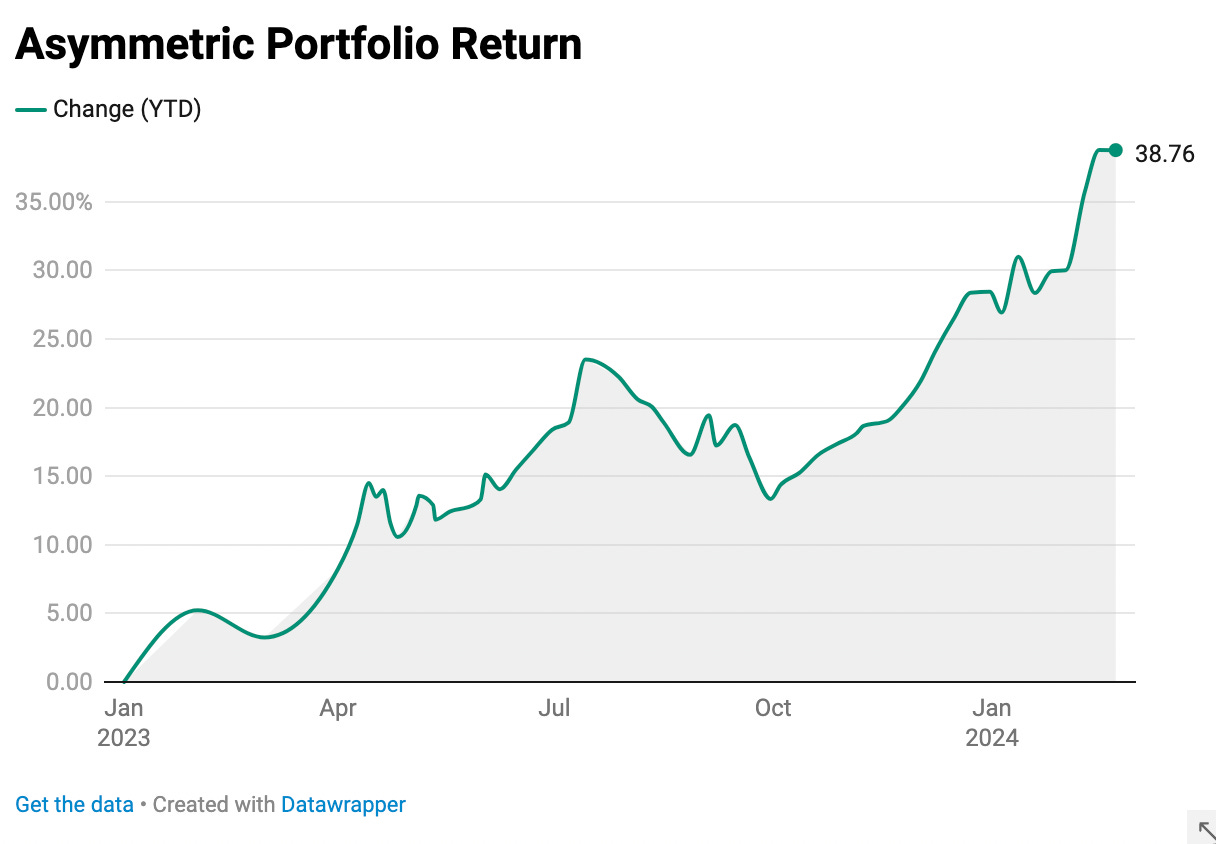

Meanwhile, our portfolio with 50% in cash and very low-risk assets continues to outperform the market by a lot.