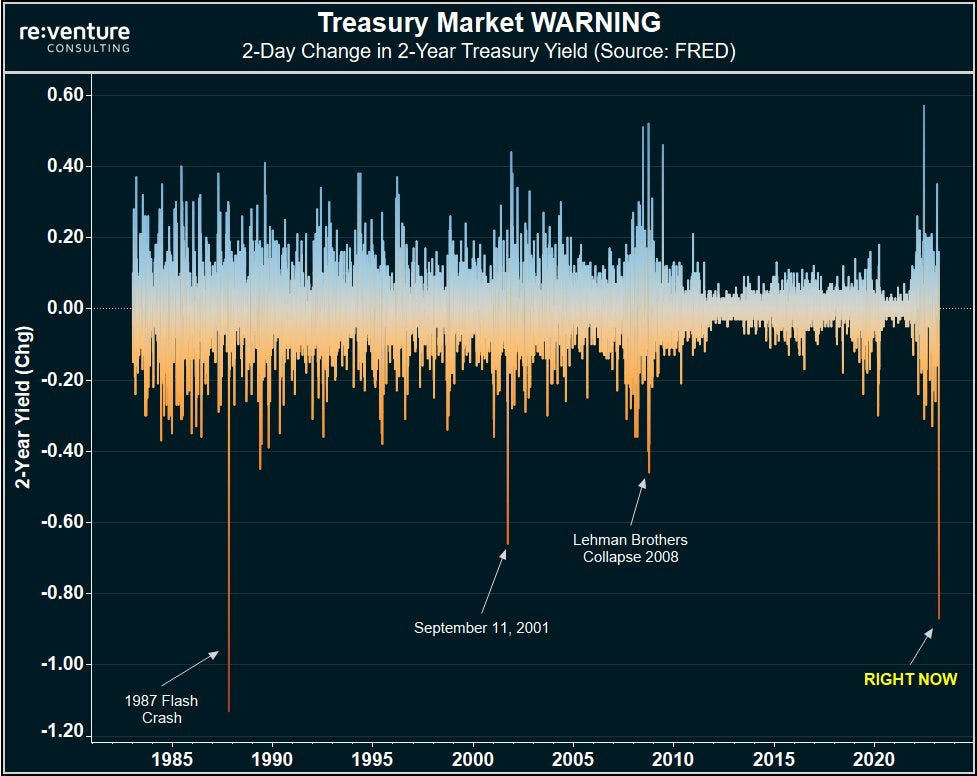

US Treasury Bills Signal the Impending Global Economic Apocalypse!

Never seen since Lehman Brothers collapse

If on Tuesday we were already telling you that the week was going to be interesting with the inflation data and the bankruptcy of Silicon Valley Bank at the end of last week, Wednesday, Thursday, and Friday have not disappointed.

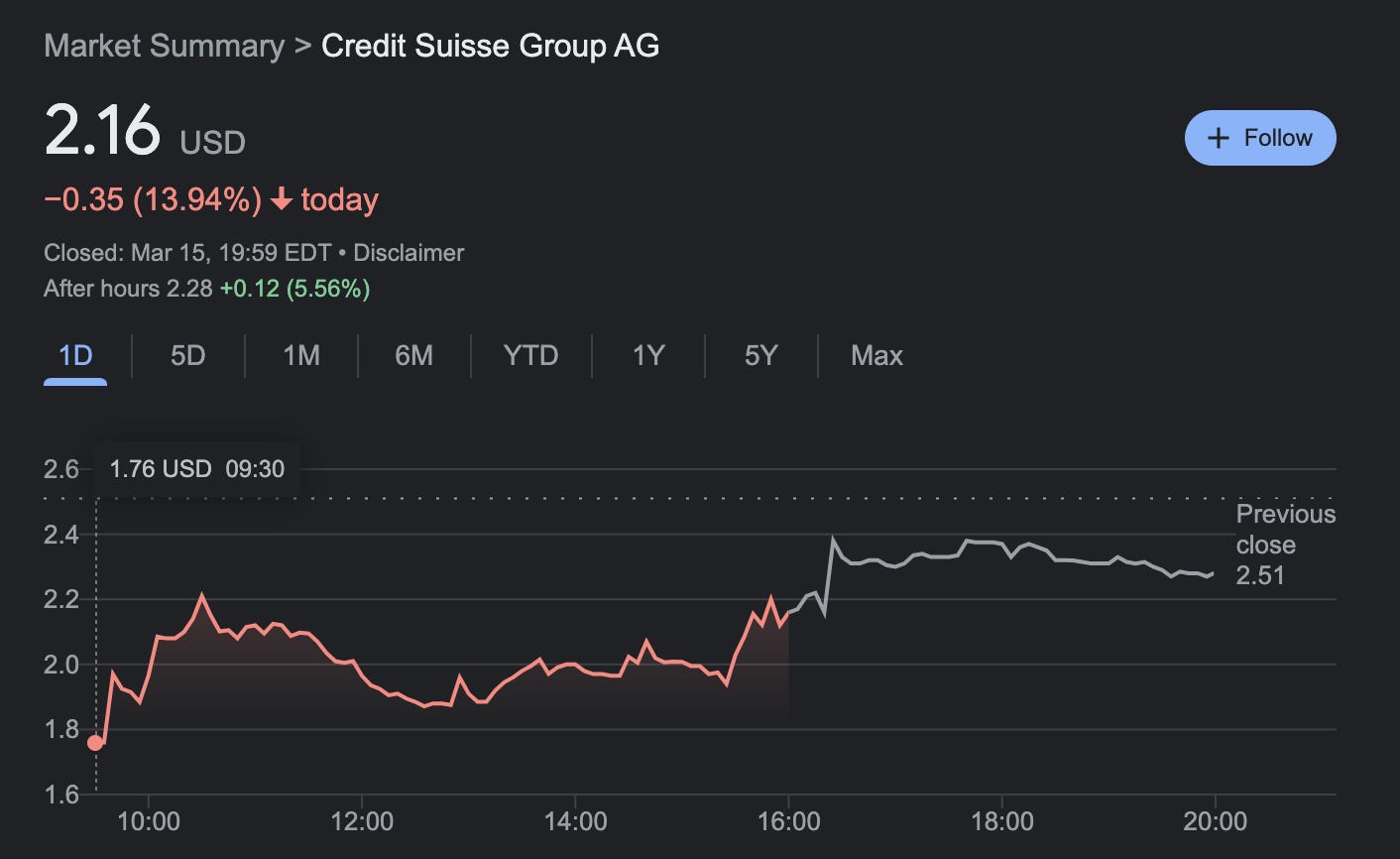

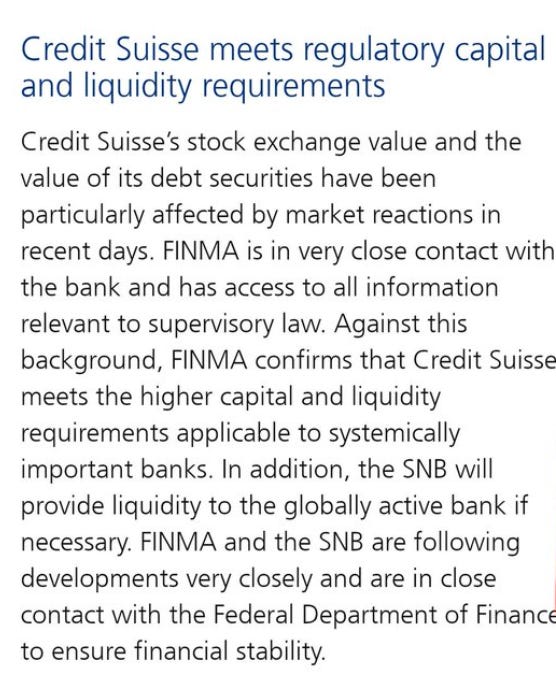

On Wednesday, we saw Credit Suisse's disproportionate plunge at the opening (-30%), only for it to eventually recover due to indications of a bailout package from the Swiss central bank.

As always, central banks come to the rescue of banks with unprecedented aid to prevent catastrophes that they themselves have prepared. These aids, in case you didn't know, are paid for by all of us.

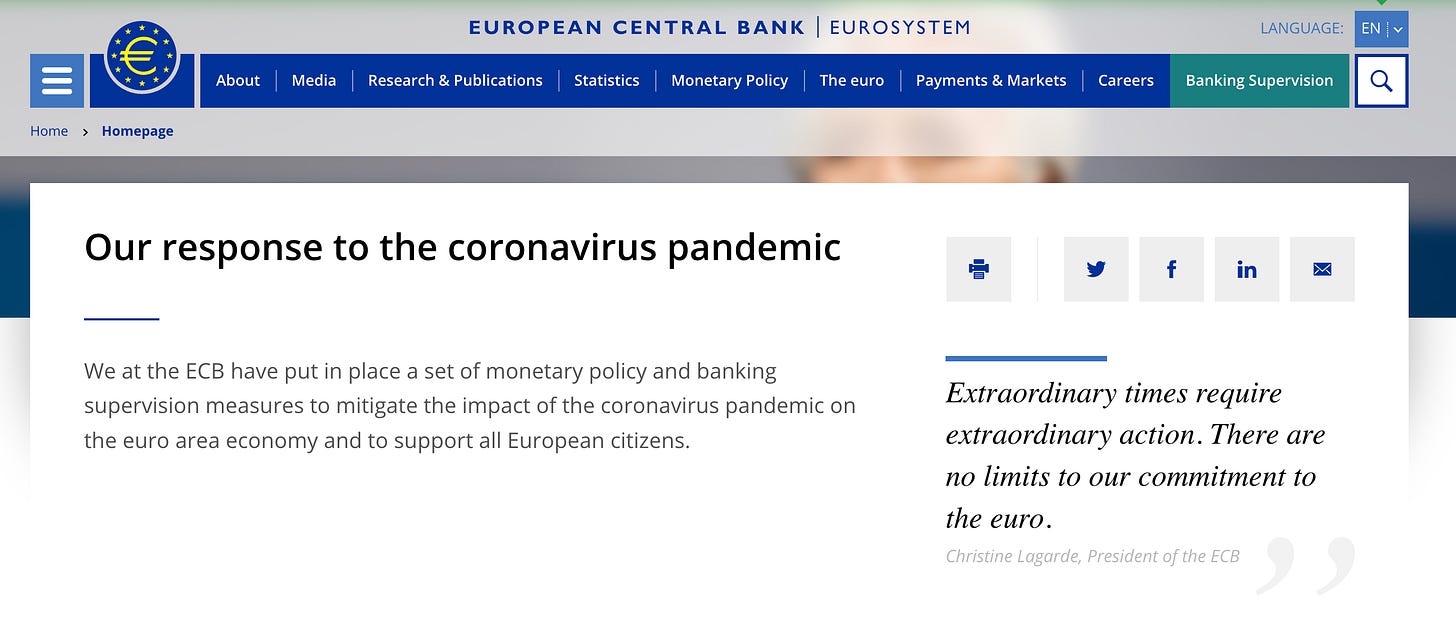

For those who have already erased it from your minds, we want you to see the difference between the fear now and the fear that existed in March 2020 with Covid and most central banks.

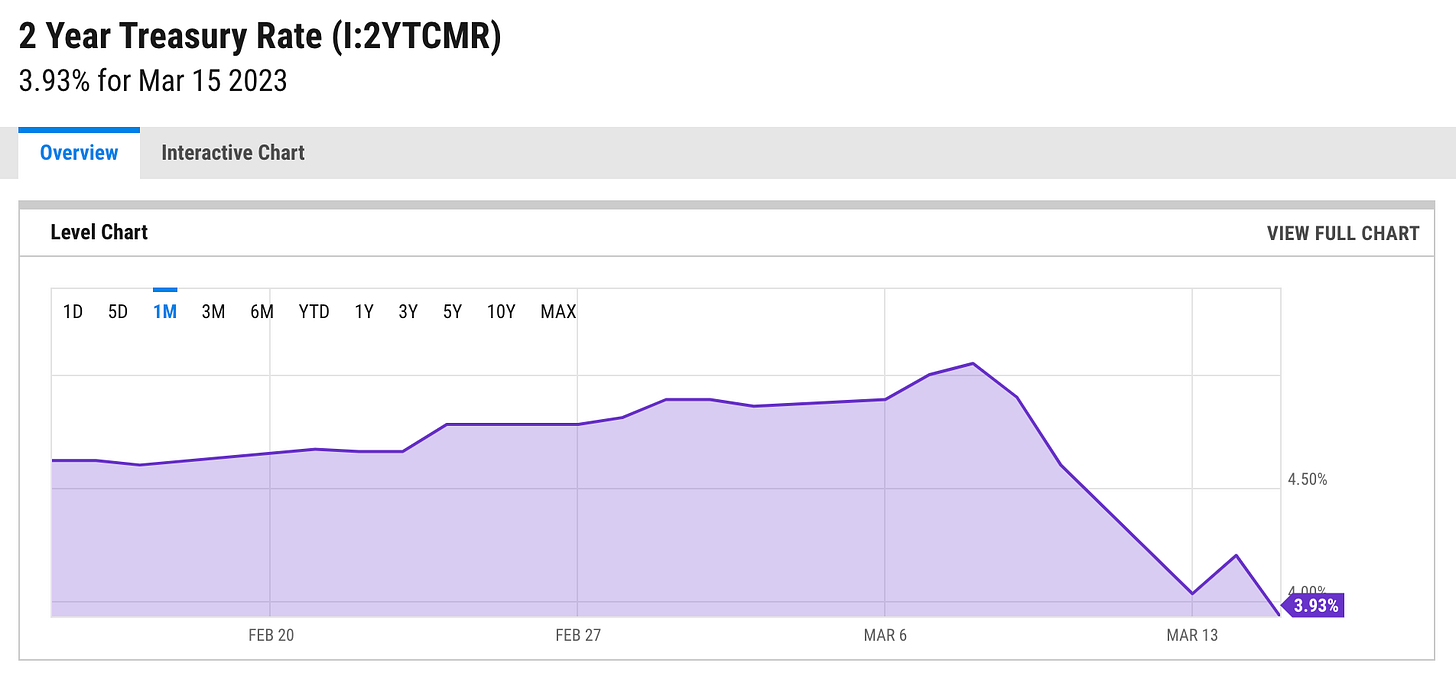

Amidst this whirlwind of events, one that is going largely unnoticed is the significant fluctuation of short-term US Treasury bills.

95% of society does not know what this means, so I will try to explain it as if to a 10-year-old.

Imagine that US Treasury bills are like little pieces of paper with letters and numbers written on them. These little pieces of paper are essential because they represent the money the US government must pay back to those who have lent it money.

Now, sometimes many people want to buy these little pieces of paper, and other times not so many people are interested in buying them. When many people want to buy them, the price of the little pieces of paper goes up, but when not so many people are interested in buying them, the price goes down.

This rise and fall in the price of the little pieces of paper is what we call "volatility." When there is a lot of volatility, it means the price is changing a lot and very quickly over a short period.

It is essential for the US government to maintain stability in the price of these little pieces of paper because if the price changes too quickly, it can cause economic problems for the country and those who invest in them.

When the price of US Treasury bills falls very rapidly, it can be a signal that something is wrong with the country's economy. For example, it could be that investors are worried about the health of the economy and decide to sell their Treasury bills to buy other assets considered safer, like gold.

When many people sell their Treasury bills simultaneously, the supply of Treasury bills increases, and the demand decreases, causing their price to drop. This rapid decline in the price of Treasury bills can have negative effects on the economy, such as raising interest rates and making it more challenging for the government to finance itself through the issuance of public debt.

In summary, a rapid drop in the price of US Treasury bills can be a sign of broader economic problems and may have negative effects on the country's economy and those who invest in them. Therefore, it is essential for the US government to closely monitor market behavior and take measures to ensure the stability of the economy and financial markets.

And what is happening today?

That is why it is absolutely necessary to have a non-correlated portfolio and invest in potential black swans that are happening and will happen, like ours. In life, you only need to be right once to make a lot of money.

In the meantime, we are confident that the Fed will come to the rescue, and by December, there will be ample liquidity in the markets, and interest rates will have dropped by at least 1%.

This will undoubtedly benefit our long-term position.