We are at a Critical Moment for Cryptocurrencies: Bull Run or Bull Trap?

Genuine opportunity

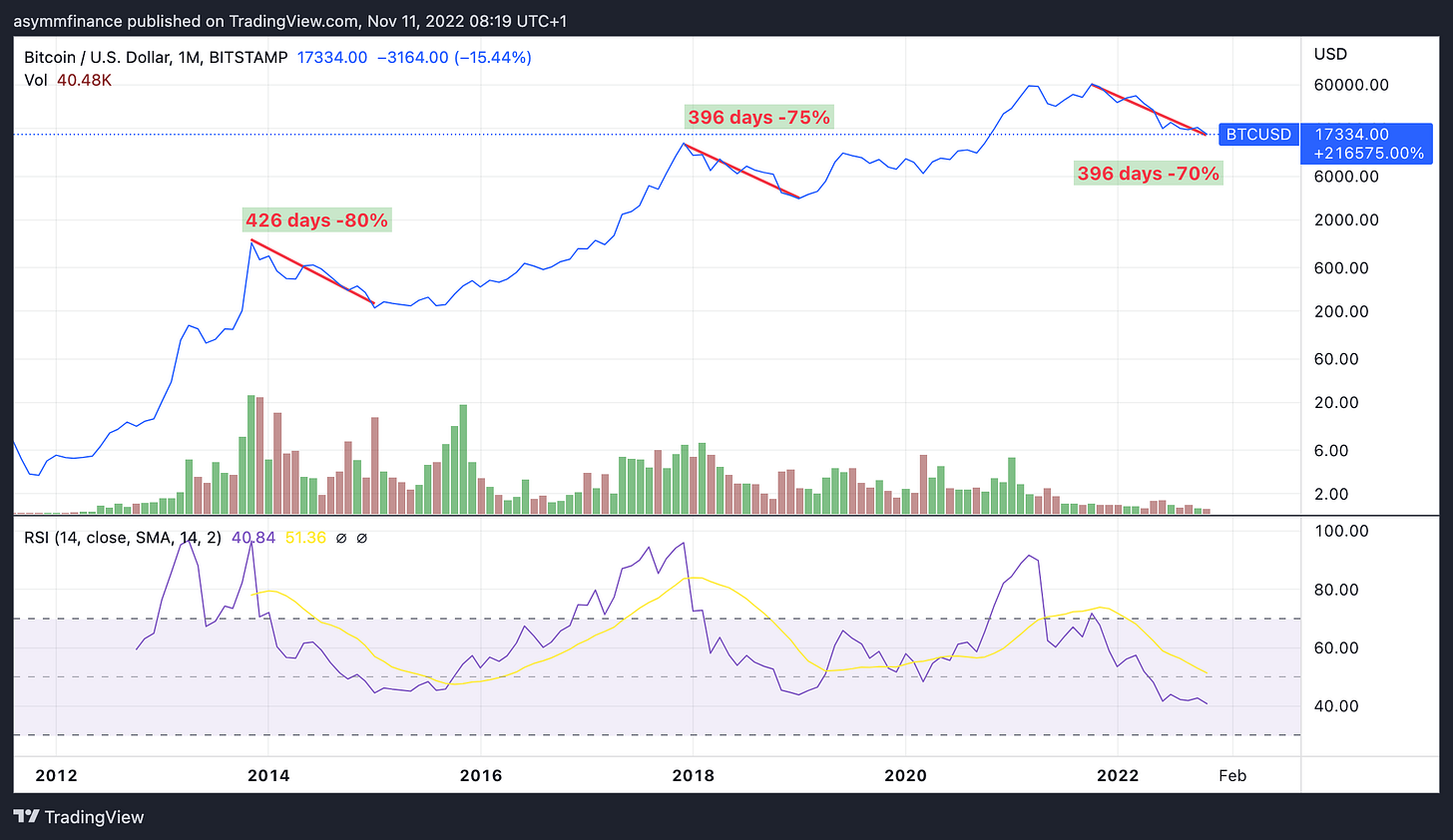

The cryptocurrency market is known for its volatility, and in just a week, the market has taken a drastic turn. Bitcoin's price was hovering around $16,000, and there was a widespread sense of fear and uncertainty in the market. Investors were apprehensive of the FTX situation worsening, Genesis potentially going bankrupt, and the potential contagion effect this could cause. Adding to this, several experts were predicting a deep recession in 2023, with predictions of Bitcoin's price slipping to $12,000 or even lower.

In November, I warned you that we were at the lows and our subscribers bought around $16k.

However, fast forward to the present, and the Bitcoin market has transformed significantly. The price has surged to over $21,000 in just a few days, with the possibility of it reaching even higher. The mood in the market has turned bullish, with many investors regaining their confidence and returning to the market. There is a growing sense of optimism that the market bottom has been reached, and the market will begin to recover after a year of pain.

Despite the newfound positivity in the market, investors are still asking themselves if this Bitcoin rally is genuine or if it is another instance of market manipulation.

In my professional opinion, this rally is real. The market has reached a point where there are no more sellers, leaving only the HODLers who never plan on selling. The statistic that nearly 65% of Bitcoin hasn't moved within the last year supports this sentiment, as it indicates that long-term investors are not selling their holdings.

Moreover, the halt of the massive coin sell-off by Bitcoin miners is a key catalyst for the current rally. Each bear market cycle features a moment of capitulation for BTC miners when mining becomes unprofitable and forces them to sell massive amounts of Bitcoin. This cycle has now completed, with the sell-off ending, and Bitcoin beginning its march toward the next bull run.

Another reason why this rally is real is that there is finally some peace in the market. While the Genesis situation is still looming, there have not been any confirmed insolvencies since November of last year. The Bitcoin market is finally recovering from the FTX fiasco and has returned to price levels seen before it took place. Recent news that FTX has more capital on hand than anticipated has also bolstered bullish sentiment.

While there are companies such as FTX and Genesis that would benefit from prices in the crypto market going up, I believe that this recent rally is not a result of market manipulation. The vast majority of the market is made up of individual investors who are not affiliated with these companies, and the recent rally's timing may just be a result of the market's natural cycle.

However, it's essential to be cautious and vigilant in investment decisions as the cryptocurrency market is still the "Wild West." Nevertheless, the current sentiment suggests that the market is heading in a positive direction.

Now, let's discuss why this rally may not be genuine. While the recent rally has been a breath of fresh air, there is still a sense of suspicion and concern among investors. The timing of this rally feels too convenient, and several companies would benefit significantly from prices in the crypto market going up. For example, companies such as FTX and Genesis owe billions of dollars to their creditors and will likely be paying back creditors in dollars rather than crypto. They have the power to pump the crypto markets, and the fact that nearly 65% of Bitcoin has not moved within the last year makes it easier to manipulate and pump the price.

As a result, there is a possibility that this rally could be the result of market manipulation. However, this is just a conspiracy theory, and the likelihood of this scenario playing out is low.

In conclusion, while there is still some uncertainty surrounding the cryptocurrency market, I believe that this recent rally is genuine. The market has reached a point where there are no more sellers, and the recent halt of the massive coin sell-off by BTC miners is a positive sign for the market's recovery. Additionally, there haven't been any confirmed insolvencies in the market since November of last year, and the news that FTX has more capital on hand than anticipated has also boosted bullish sentiment.

In conclusion, the recent surge in Bitcoin's price has provided a sense of relief and optimism for investors after a year of market turmoil. While the rally's authenticity may be questioned by some, the market's natural cycle and the absence of major insolvencies suggest that this rally is genuine. However, as always, investors should be cautious and prepared for any potential risks.

Now, like every week, our asymmetric portfolio in detail where you will see the incredible performance of Bitcoin within our portfolio.