What Do the Elite Regret at 40?

Why High Earners Still Feel Poor

At one of my best friend’s weddings, I ran into one of the brightest minds I’ve ever known.

A retired professor. Mathematician. Author of textbooks on algebra and engineering. He taught at one of the top technical schools in the country, and over his career, witnessed entire generations of brilliant minds pass through his classroom. I approached him respectfully, told him I had been one of his students, and thanked him.

“What do you do now?” he asked.

We chatted for a few minutes. I told him I work on building systems for financial freedom, designing structures where people can live off their cashflow not from assets marked to market. He looked at me with curiosity, and slowly began to share stories.

“I had brilliant students. Very brilliant.”

He mentioned one in particular. The youngest partner in the country’s history at McKinsey. Thirty years old, earning one or two million a year. Absolute elite. But that’s not what struck me. It was what came next.

“At forty, he quit. He was tired. Wanted a quiet life. Time. No bosses, no structures, no monthly targets. Just freedom. He had a very kind voice. He was a thinker.”

And something clicked in me.

This wasn’t the speech of someone who despised success. On the contrary. It was a testimony from someone who had seen the best. Who knows what lies at the end of the road once you’ve achieved it all. And what’s left, once you turn down the ego, is freedom. Not more stuff. Not more status. Just time. And direction.

He also told me about other students. Some who never managed to leave. Trapped by addiction to recognition. By the weight of their expenses. By the impossibility of stepping off without their entire system collapsing. Not because they weren’t smart. But because they hadn’t designed their life structure around optionality.

And that’s it.

It’s not about having more. It’s about being able to choose. Having fewer things that own you. Fewer burdens, fewer liabilities, fewer fixed commitments that suffocate your soul. Freedom is the space between what you need and what you can generate without selling your life.

This doesn’t happen by luck. It’s built. With structure. With financial education. With mental clarity. With separate boxes: your cashflow box, your core asset box, and your optionality box. Most people live with one box only: their job. If that breaks, everything breaks. The person with three boxes can breathe. Can pause. Can think. Can pivot.

That’s the kind of wealth that matters. Not what’s shown on Instagram, but what lets you not smile if you don’t want to. Not answer if you don’t feel like it. Not stay if you’re already gone inside.

The professor, with his quiet wisdom, confirmed it to me: even among the best, freedom is rare. Because it demands a very unglamorous decision living with less, but with direction. Designing systems that don’t depend on your energy peak or your boss’s opinion. Investing in yourself not to perform more, but to need less.

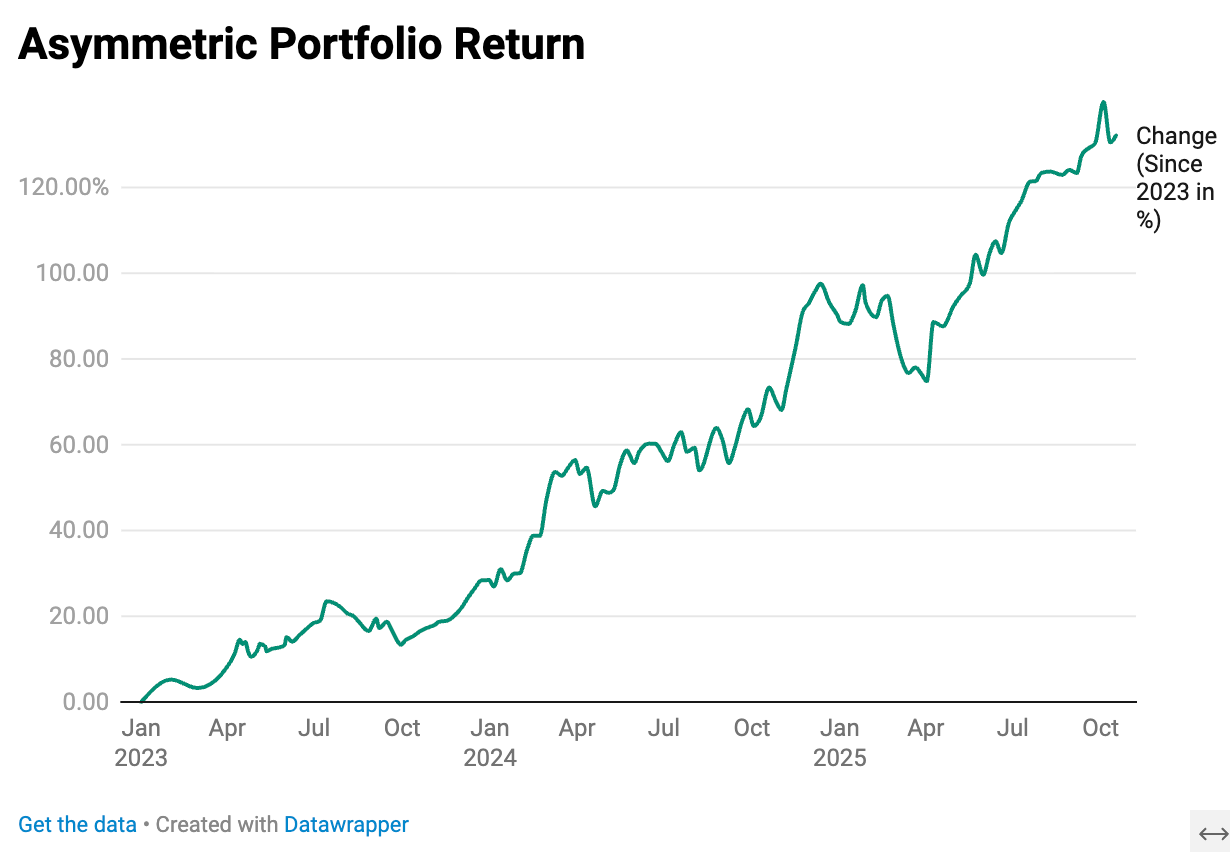

Building an asymmetric portfolio isn’t just about maximizing returns. It’s about maximizing freedom. Earning monthly income from assets you don’t sell. Having unused margin to strike when everything breaks. Holding mental liquidity to live without anxiety.

It’s not complicated. But it’s so countercultural it feels revolutionary.

The real question isn’t how much you make. It’s how much you could stop doing tomorrow without your life falling apart.

Start by calculating how many months you could live today without selling anything, just with the cashflow your assets generate. Look coldly at how many fixed commitments you carry that force you to keep running nonstop. From now on, separate your financial life into three boxes: one to live (cashflow), one to hold (core), and one to strike (optionality). Allocate a percentage every month to that freedom box not money to spend, but money to choose. And study closely those who already got out of the game. Those who no longer need to run. Who don’t depend on recognition or adrenaline. There’s often a key there that’s not in any book or course.

Freedom is not a goal. It’s an architecture. And you need to start building it now, before it’s too late.

NOW OUR PORTFOLIO…