What Taleb Gets Right About Gold and Inflation

Is Gold the Real Reserve Currency Now?

For a long time I haven’t spoken about one of the thinkers who, without exaggeration, has shaped how I look at risk, optionality, and the world itself. Not just in investing, but in the way one builds a framework to survive uncertainty. I’m talking about Nassim Nicholas Taleb.

Taleb is not someone who chases renown, at least not in the conventional sense. He often comes across as arrogant, even hostile, but behind that sharp edge lies a body of work that has forced thousands of investors, traders, and entrepreneurs to rethink their assumptions. Few people in finance or philosophy have managed to leave such an imprint. He doesn’t just teach you to make asymmetric bets. He teaches you to think.

And that is why, when Taleb speaks about gold, it’s worth paying attention.

Gold has always sat in an awkward corner of portfolios. It’s loved by doomers, hated by modern financiers, and largely ignored by mainstream asset allocators who would rather own another tech ETF than deal with a lump of metal that yields nothing. But Taleb has been consistently clear: gold is not just another asset, it is the anchor that makes the rest of the system possible.

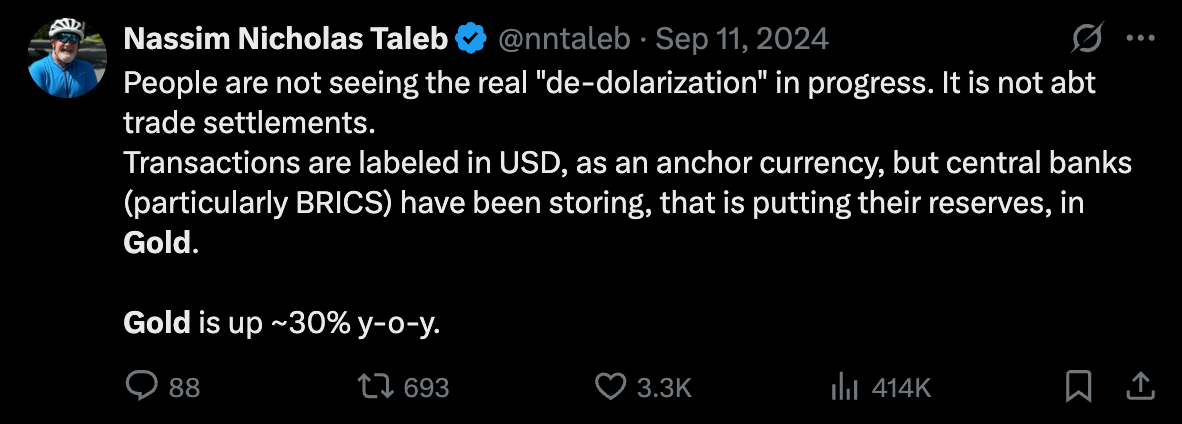

He put it bluntly in a tweet not long ago:

That line struck me because it cuts through the noise. Everyone debates about BRICS payment systems, SWIFT alternatives, and whether oil will be priced in yuan. But the real story is more subtle. Central banks are quietly moving into gold. They don’t need to declare a new monetary order. They just need to shift reserves away from the dollar. That’s the silent de-dollarization.

We already talked about it in this article: Gold Could Double Its Price in the Coming Years

And here’s the question that made me stop: what if Taleb is right, and gold is not just a hedge, but the silent core that allows an investor to stay antifragile?

I think what I’ve learned from him about gold is too important not to share.