What Would Happen If The Fed Didn't Save Us This Time?

Three possible scenarios

A global crash is closer than ever if the Fed doesn't prevent it. In early May, we thoroughly analyzed the factors behind the emerging regional banking crisis, which is not solely limited to the increases in the interest rates set by the Federal Reserve (Fed).

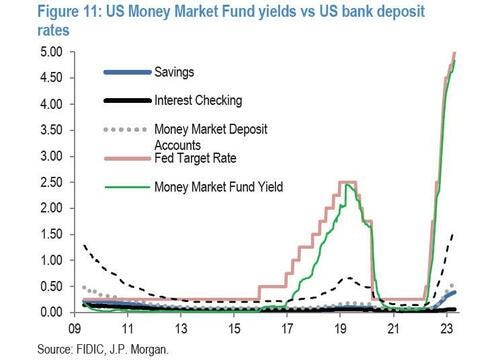

While it is true that the Federal Funds Rate stands at 5.25% and Treasury bonds and money market funds offer similar yields, making it difficult for small banks to offer attractive returns, it is important to note that the Fed's "Quantitative Tightening" (QT) policy also poses an equally detrimental threat to the viability of small and regional banks.

This means that it is not enough to simply stop raising interest rates (or even lower them), but we must have more liquidity in the markets.

We have mentioned this many times before: “liquidity guides the markets”

Under a framework of ample reserves, practically all deposits are created by the Fed. As a result, banks were forced to acquire low-yielding securities during the 2000-2001 period. However, this strategy has become unfavorable as yields soar and the prices of fixed assets and loans decrease significantly.

It is important to understand that, within the context of quantitative tightening, as the Fed's reserves decrease, deposits must also follow this trend. Consequently, deposits are forced to migrate to Treasury bonds or, in some cases, they may even be eliminated due to bank failures.

And when these loans are reduced and exit the banking system, the primary business of banks, which is lending money, becomes senseless as they lack collateral, which can lead to their bankruptcy.

Thus, the current banking crisis presents itself as an inevitable side effect of the tightening monetary policy implemented by the Fed.

In this context, it is worth mentioning the crucial role of JPM, an entity that currently controls over 13% of national deposits and 21% of credit card spending in the country. This bank has emerged as a systemically important institution of unprecedented importance. Furthermore, each failure of smaller banks in the sector only contributes to strengthening the dominant position of this institution, led by the influential Jamie Dimon.

https://twitter.com/asymmfinance/status/1660884290073182208?s=20

Just a few days ago, Jamie Dimon himself confirmed our previous statements about the potential impact of quantitative tightening.

Dimon expressed his concerns about how deposits will evolve in a quantitative tightening scenario, highlighting his particular unease compared to other event attendees.

It is important to keep in mind that although the Fed has always taken action, there is no guarantee that they will do so again. It is essentially like thinking that a drug dealer for a junkie will never die. In fact, the chances of that happening are much higher than we might expect.

This makes us think a lot about how we should protect our savings and how to anticipate such unprecedented events.

For this, we have taken three initiatives: