What's Happening With Bitcoin and Target Price?

Is Your Portfolio Missing Out? The Bitcoin Phenomenon Explained

For the past three days, every morning when I check my email, I'm greeted with questions like, "Should I sell my Bitcoins?" and "What's behind Bitcoin's recent surge?"

I've received up to 12 emails addressing these concerns. Despite the presence of skeptics, I see that there are people who have become early adopters aiming for a home run.

If you're indifferent to these questions, let me provide some context.

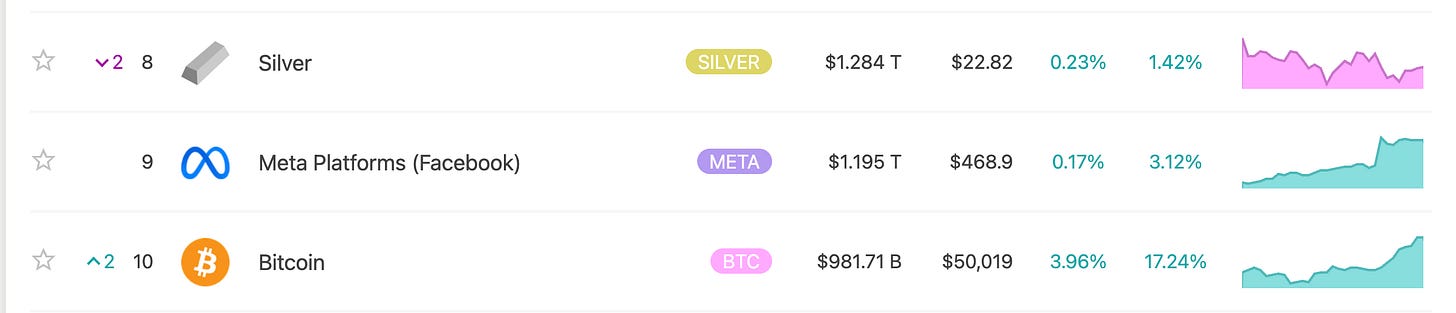

Over the last week, the prices of Bitcoin and Ethereum have appreciated by 17% and 14% respectively (as of writing this on February 13th).

Bitcoin is on the verge of reaching a valuation of $1T, surpassing Meta as the ninth largest asset in the world.

Many still consider it a bubble, or think its valuation makes no sense. Currently, if it were a financial sector company, it would be the largest in the world, ahead of Berkshire (which is not exactly a bank), Visa, JPM, among others.

You might think this is a temporary phenomenon, but one thing about Bitcoin is clear: anyone who has studied money and this type of digital currency has no doubt that it is the future. It might not be Bitcoin, but blockchain technology for sure.

Each time you pay with your card at the supermarket, remember the process: your money goes to a third-party bank, which contacts your bank to check if you have funds. Your bank confirms, transfers the money to the third-party bank, and finally, the store receives the payment in its account after 2-3 days. Efficient? Far from it. Up to four entities can be involved in such transactions.

With Bitcoin (and blockchain technology), it's becoming more common to see videos of people making person-to-person payments at markets quickly, instantly, and without intermediaries.

But let's get to the point, I want to explain what has happened with Bitcoin this week and what you should do.

It's a perfectly reasonable question, especially since we recommended buying 3% of your portfolio in Bitcoin at $16k in November 2022, and today it has appreciated more than 200% in just over a year.