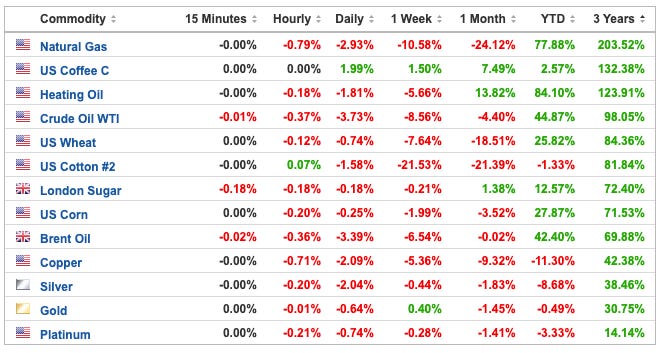

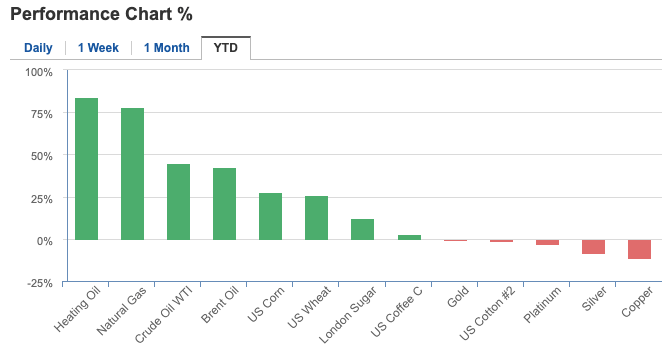

Over the last few months, it is not uncommon to see day in and day out that the price of certain commodities has reached record highs.

Many of these commodities have multiplied x5, even more than the price they had just a year ago. The same has not happened in the case of gold and silver. In the last three years, there is only one commodity that has done worse, Platinum.

Even so far this year, we can see that performance, although better than stocks, and especially commodities are still negative. In the case of silver -8.6% YTD.

Today I'm going to tell you when gold and silver will really start to rise. And why, with inflation at a 40-year high, it is still not doing so.

Many investors in times of inflation take refuge in real or limited resources (hard assets). This is the case with Real Estate, gold, and possibly Bitcoin.

In other words, as soon as they smell a crackdown, retail investors go straight to gold if the CPI is high. However, with the S&P500 down more than -20% from its highs, nothing has yet happened to the price of gold.

The answer is very simple. The market does not expect particularly high inflation in the future. In fact, by gold's YTD return, the market expects quite the opposite.