When Will a US Debt Crisis Happen? ChatGPT Weighs In

How Rising U.S. Debt Could Crash the Global Economy

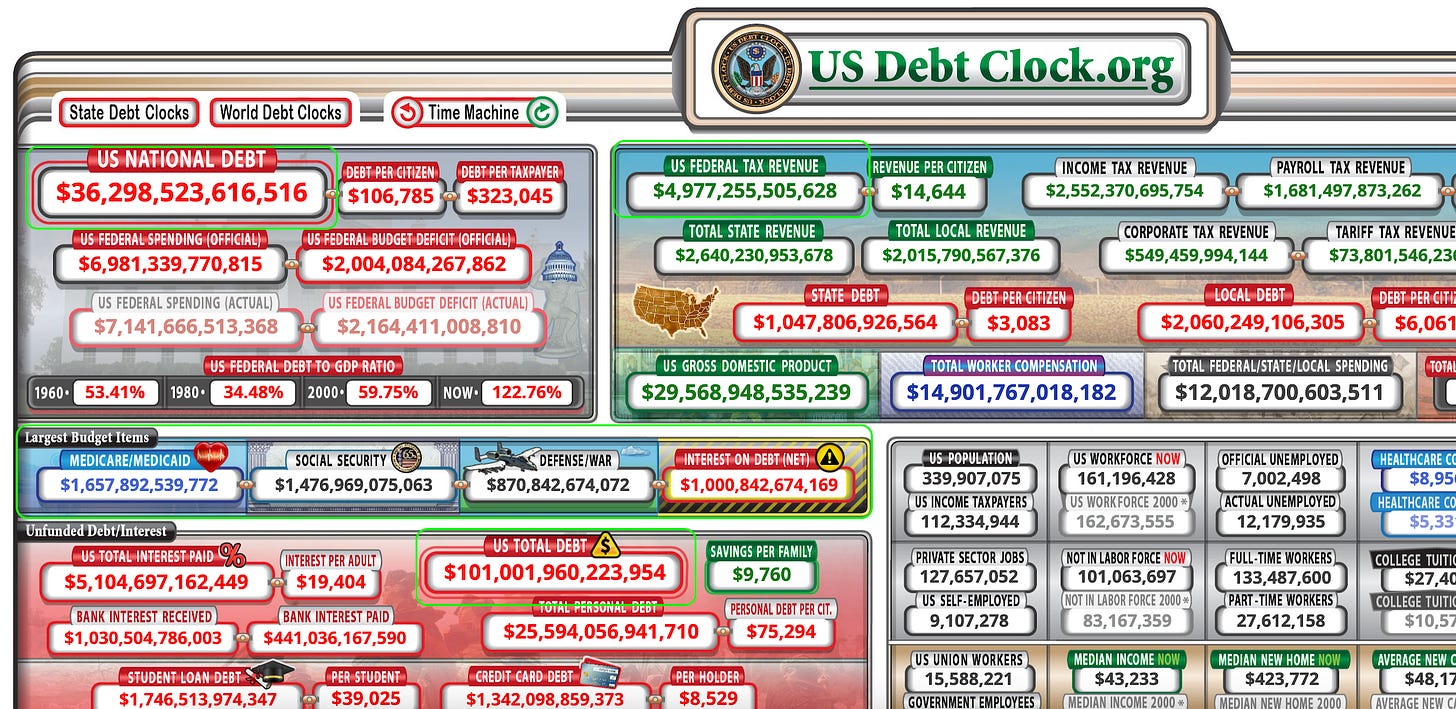

One of the websites I like the most and that I think provides a better understanding of how the American economy works is https://www.usdebtclock.org/

On this site, we can see the U.S. national debt in real-time, as well as all the revenue collected through taxes.

Now, some people might write to me asking why we only focus on the U.S. and not other countries. Well, if you want, you also have the option to see the details by country.

You can also view the gold reserves of each country, all in real-time. As an engineer, I don’t know the source of this data or how this real-time integration works, or whether it’s an estimate based on a model. Regardless of how it works, it’s a website worth visiting.

If we dive into the details of the data provided, I think we should focus on a few key points:

US National Debt

This represents all the debt held at the U.S. government level. This debt is generally used to fund four items:

Largest Budget Items: Medicaid, Social Security, the military, and interest payments.

US Total Debt

This includes all the debt held by both the U.S. government and American citizens themselves.

If there’s one figure I find particularly concerning, it’s the interest payments. Interest payments now represent a significantly larger portion than what is spent on the military. The main problem is that if you cannot collect more than you spend, let me tell you, you’re in big trouble.

The website also allows you to view future projections, specifically for the year 2029.

If we look at both snapshots, regardless of the fact that public debt is set to skyrocket to $48 trillion, we notice something interesting: interest payments will become the largest expenditure category.

So, what did I do? I uploaded the current and future projection images of U.S. debt to ChatGPT and asked the following:

"I’m going to share two images with you: the current US debt and the amount paid in interest (image 1) and the projection for 2028 (image 2). Based on this projection, when would the US default on its debt, and when would the growth become unsustainable?"

To which ChatGPT responded:

Let’s analyze numerically why the projected growth of U.S. debt would be unsustainable, based on the data provided.

Current Situation (2024):

National Debt: $36.28 trillion.

Annual Interest on Debt: $1.03 trillion.

Debt-to-GDP Ratio: 123.45%.

Current GDP: $29.40 trillion (approx. using the debt-to-GDP ratio).

Estimated Annual GDP Growth: 2.0% (historical average growth).

Projection for 2028:

Projected National Debt: $51.15 trillion.

Annual Interest on Debt: $4.54 trillion.

Projected Debt-to-GDP Ratio: 157.06%.

Projected GDP in 2028: $32.58 trillion (growing 2% annually from $29.40 trillion).

Key Variable Comparison Between 2024 and 2028:

Increase in National Debt (2024-2028):

Debt rises from $36.28 trillion to $51.15 trillion, a 41% increase.

GDP grows only by 10.8%, from $29.40 trillion to $32.58 trillion. This disproportionate growth causes the debt-to-GDP ratio to spike.

Growth in Debt Interest:

Interest on debt increases from $1.03 trillion to $4.54 trillion, a staggering 340% increase in just four years.

By 2028, debt servicing will consume over 65.57% of federal revenues (projected at $6.92 trillion). This leaves minimal room to fund essential government programs like defense, Medicare, or Social Security.

Debt-to-GDP Ratio:

The projected 157.06% in 2028 shows that debt is 1.57 times larger than the annual GDP. Generally, a debt-to-GDP ratio above 100% is already a red flag for markets.

Investment vs. Interest Payments:

In 2024, interest accounts for approximately 20% of federal revenues, a manageable level.

By 2028, this share increases to 65%, meaning nearly all revenues would go toward interest payments, leaving little for stimulus policies or deficit reduction.

Projected Unsustainability:

Exponential Growth of Interest Payments:

With interest growing far faster than federal revenues or GDP, the government will need to refinance debt continually.

If markets lose confidence (e.g., through higher risk ratings or increased interest rates), the cost of servicing debt could accelerate even more.

Accumulated Deficits:

The projected deficit in 2028 is $4.71 trillion annually, further accelerating total debt growth.

Collapse Due to Refinancing Costs:

As interest payments exceed the government's capacity, new debt will be issued to pay interest on old debt, creating a vicious cycle.

This could lead to technical insolvency or a debt crisis if left unchecked.

The conversation didn’t stop there. I specifically asked ChatGPT to estimate the year when the government would default based on previous debt crises and what this default could entail.

If current trends continue, the U.S. government could face a debt crisis around 2028-2030. This would happen when:

Interest payments consume more than 70-80% of tax revenue.

The debt-to-GDP ratio and deficits become so large that investors demand higher interest rates to lend money, further increasing costs.

Key Lessons: Critical Thresholds

Historically, 30-50% of interest as a share of fiscal revenue is a critical point. In some cases (like Sri Lanka), the threshold may reach 70%, but at this level, a crisis is practically inevitable.

Sustainability also depends on factors like economic growth, access to financial markets, and investor confidence.

Lastly, I asked what would happen if this debt crisis occurred—a scenario we have faced many times before (read Ray Dalio). I also wanted to know how to protect myself in such a scenario.

Implications of a U.S. Debt Crisis:

Impact on Financial Markets:

U.S. Treasury bonds, considered the ultimate "risk-free" asset, would collapse.

This would trigger a massive global confidence crisis, worse than 2008.

Dollar Depreciation:

A loss of trust in the dollar as the world’s reserve currency could cause it to devalue drastically.

Alternatives like the yuan, euro, or even cryptocurrencies like Bitcoin could rise in prominence.

Global Recession:

Reduced U.S. imports would harm major exporters like China, the EU, and Mexico.

A global credit crunch would exacerbate economic slowdowns.

Geopolitical Shifts:

The U.S. could lose its economic and political dominance, with other powers filling the vacuum.

Conclusion:

A U.S. debt crisis would be a systemic event with global repercussions. Diversification, strategic debt use, and safe-haven assets are key strategies for navigating such uncertain scenarios.

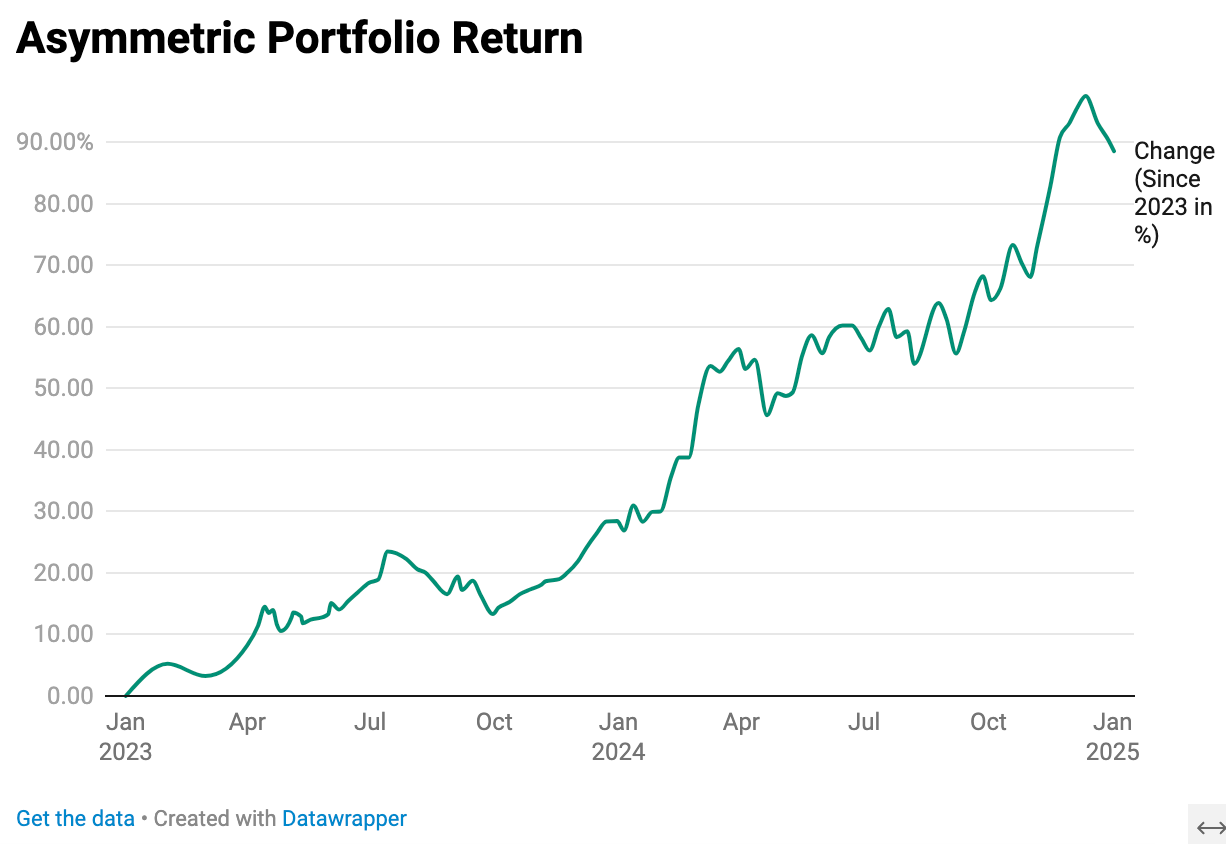

Now, our asymmetric portfolio in detail