Why 99% of What You Read About Markets Is a Waste of Time

If Headlines Don’t Make You Rich, Why Do You Still Read Them?

The other day a subscriber wrote to me saying that many of my articles are not about current events. He wanted more news flow, more updates on what is happening right now.

I thought about how to answer him, and I believe the best way is to write this piece. If someone reading this prefers to only follow the latest news, that is fine, they are free to unsubscribe. But for those who stay, I want to explain why I focus on timeless writing and not on headlines.

The problem with most economic writing is that it dies fast. Newsletters, blog posts, even entire books, get trapped in the present moment. They talk about the latest inflation number, the market’s reaction to the Fed, the chart that everyone on Twitter is retweeting. But one month later, it all feels like yesterday’s newspaper. Forgotten. Irrelevant.

If you have been around markets for more than a decade, you already know this. What felt like a crisis, what felt urgent and absolute, is now a footnote. The 2011 debt ceiling fight. The 2015 China devaluation scare. Even COVID, as brutal as it was in real life, is just one more liquidity shock in a long chain of them. Markets moved, fortunes changed, but the daily headlines did not survive.

That is why I prefer writing, and reading, what lasts. Principles, not noise. Lessons that make sense not only today, but ten years from now. And one of the most important lessons I would give to anyone starting out, whether you are 20 or 30, is this: ignore the news flow. Do not build your financial life around the latest headline. Build it around assets that will still matter when the headlines are gone.

Because the real opportunities are rare. They are the deep dislocations, the moments when the system breaks and you have the courage to act. Most people freeze in those moments. Or worse, they get distracted by the small stories, the hot takes on the latest jobs report, and they miss the only thing that matters. If you are patient, if you are prepared, you do not need to chase eight day candle moves. You just need to recognize the once in a decade shock when it comes, and step into it.

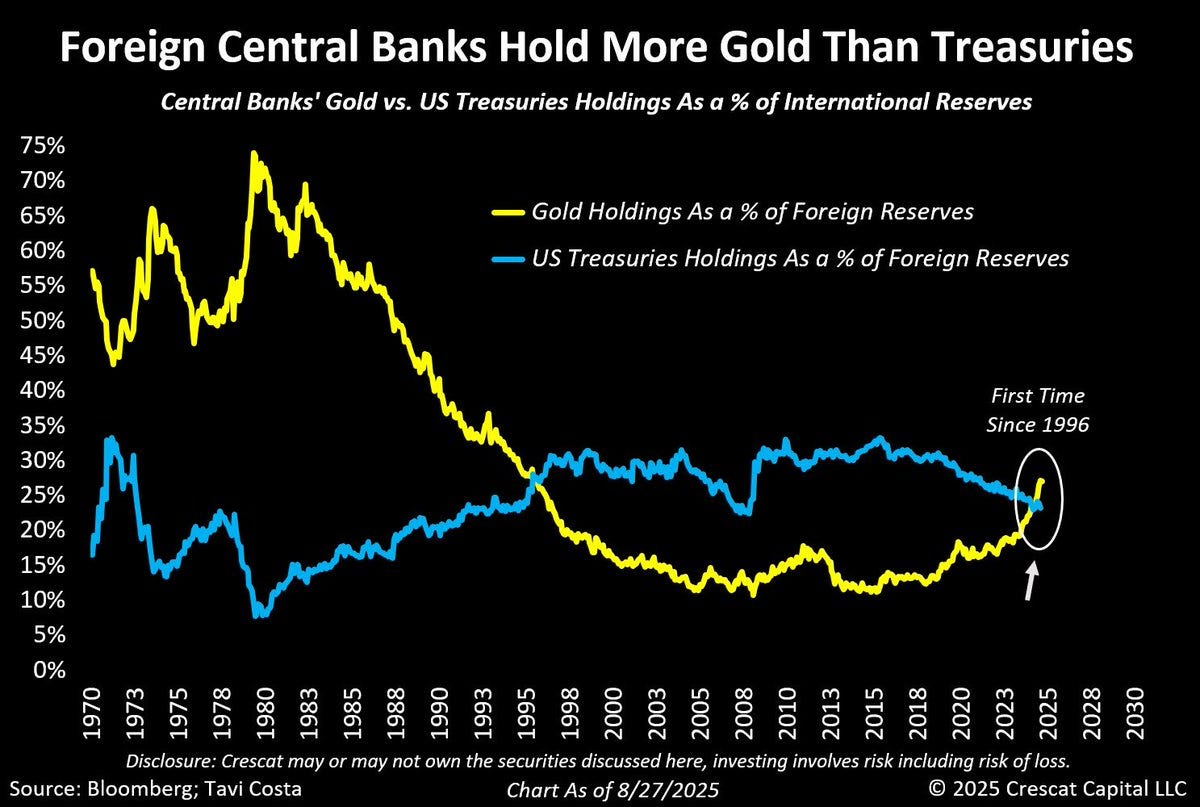

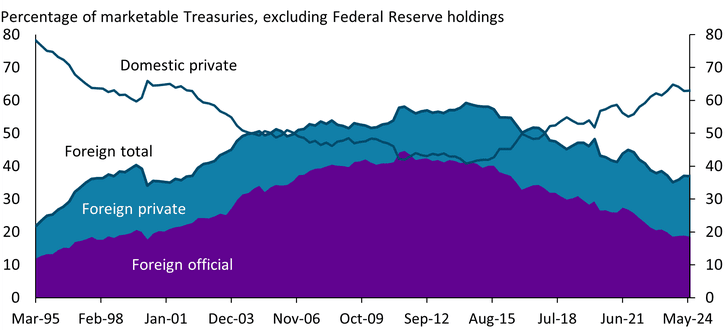

Let us put this into context. For the first time in 79 years, central banks now hold more gold than US Treasuries as a share of their reserves. Think about that. For decades, the American Treasury bond was the ultimate reserve asset. Safe, liquid, backed by the strongest economy in the world. But slowly, quietly, that dominance has eroded. Foreign demand for Treasuries has been shrinking for years. Official buyers have stepped back. Private buyers too. And instead, central banks have been buying gold.

This is not a headline of the day. It is not noise. It is a secular shift. A 40 year trend bending in a new direction. And it tells us something simple but profound, the world is diversifying away from the dollar. Slowly, carefully, but decisively.

Now, if you are 20 years old, this does not mean you should panic and short the dollar tomorrow morning. That is the trap of trading the news. Instead, it means you should understand the game board is shifting.