Why Holding Dollars is a Mistake

Gold vs. Stocks

One of the most storied love-hate relationships in the history of investing is between stocks and gold.

Warren Buffet, one of the greatest investors known for analyzing companies, famously remarked that humans dig up gold, often at great expense, to bring it close to our homes, dig another hole, and bury it again to guard and protect it. This, he believed, illustrated the absurdity of owning gold.

Moreover, gold does not generate cash flow or contribute to economic productivity.

Up to this point, I completely agree. However, I think we need to understand money in a much more abstract way. Warren knows this, and from my admittedly limited perspective, I believe he speaks from the viewpoint of the retail investor. It's much simpler for an individual to buy stocks and understand what they're doing than to do the same with gold.

However, gold has an underlying value that we must grasp, and this understanding only comes with a broader perspective on what money truly is.

Money is a medium of exchange created by countries to incentivize their citizens (and those of other countries) to acquire various services.

95% of all currencies throughout history have disappeared, and 100% have depreciated against gold.

This implies that we should view gold not as an XAU/USD conversion but as an asset that does not depreciate against the reference currency.

We live in a period of about 100 years where the international reserve currency has been the dollar. This began in the 1940s after the Americans won the war and established themselves as the world's leading power. This led major countries to acquire US bonds in dollars.

Initially, these dollars were backed by gold, so, broadly speaking, they had bonds denominated in dollars.

This taught many countries the lesson of 1920s Germany, where the government had no foreign bonds, leading to one of the worst hyperinflations in history.

But now, does it make as much sense as Warren suggests to say that owning gold is pointless?

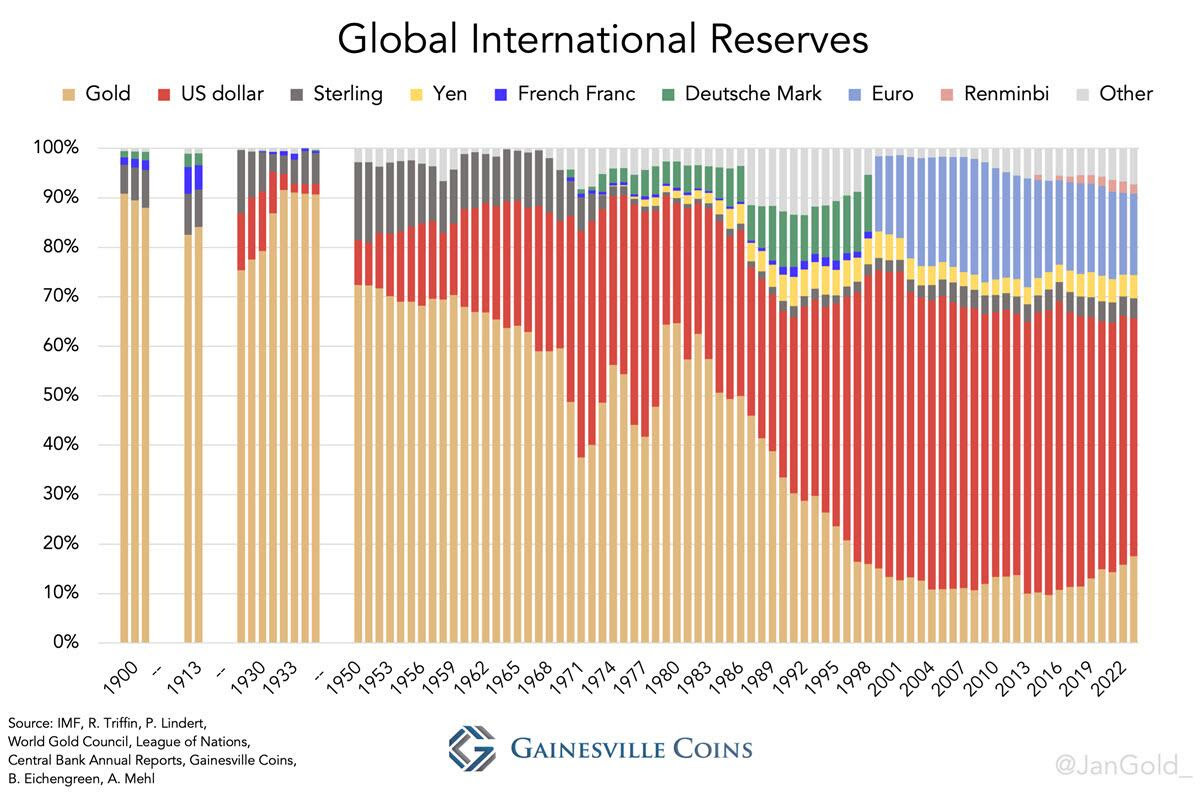

The following chart is key. We are beginning to see a shift from a world where everyone owned gold (1900) to one controlled by the dollar.

However, this will not continue indefinitely. We see how BRICS countries are gradually selling off their dollar reserves and starting to sell dollars.

This small trend change, which began in 2015, has resulted in the returns of gold versus the stock market (S&P 500) being quite similar.

After all this, I believe there are two key lessons to take away:

Money is entirely fictitious. It serves to pay for our daily pleasures, but its long-term value is negligible. We must hold assets that are either productive (stocks) or have physical properties that endure over time (gold, silver, Bitcoin).

The dollar is clearly being weakened, and while it is obviously a better alternative than other currencies (e.g., the euro), in the coming years we will see that it makes little sense to hold dollars.

Now, as we do every week, we bring you our portfolio (with ATH)