Why Investors Can't Afford to Miss This Week's Market Analysis

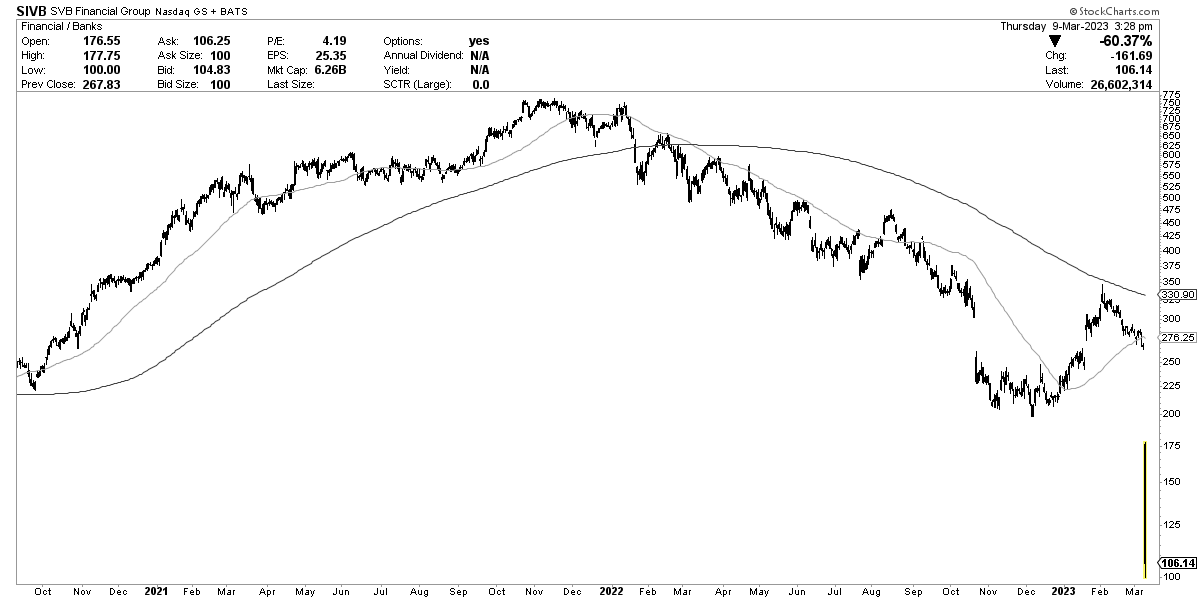

SVB and the contagion of banks

This week has seen the return of panic in the markets, which we have not seen for a couple of months.

This panic has alerted many investors who believed that interest rates would not rise further and that liquidity would return to the markets.

In fact, we have been warning of the risks for several weeks, as we have seen an excess of confidence in the markets that is not reflected in reality.

Our indicators have shown that leveraged S&P and silver positions would continue to fall, and we had advised subscribers to liquidate their positions in these assets.

This week, the U.S. bank index has declined more than 7%, which is the largest drop in three years.

Our experience tells us that when an event of this magnitude occurs, something is happening, especially when the rest of the market is balanced.

SVB Financial Group, a financial entity, has triggered concerns among depositors and investors as it suffers from a deposit run, as reported by the Wall Street Journal.

The cause of this lack of confidence is due to the bank, like many others, holding a significant amount of US Treasury bonds, which have declined by 65% since 2021. Today, the bank announced the sale of its bond portfolio, which led to a further 60% decline in value, resulting in losses and the need to raise capital.

The issue lies in the fact that banks are not required to sell their sovereign bonds at a loss, as they can be held on their books as "paper losses." However, if depositors believe that these losses may continue to increase, they may withdraw their deposits, regardless of accounting practices.

The decision of SVB Financial Group to sell its bond portfolio has materialized this reality, causing concern among investors and depositors alike.

The concern now is whether this is an isolated incident or if it will spread to other banks, leading to contagion.

The banking industry is vital and systemic, and if significant institutions experience a significant decline, it could have severe consequences for the industry and the broader economy.

The banking industry has changed significantly over the last 15 years due to regulatory changes, and banks are no longer high-leverage, risk-taking entities but well-capitalized "boring businesses."

It's crucial to note that the situation with SVB Financial Group has nothing to do with the 2008 financial crisis. While the bank has experienced losses and is in the process of raising capital, it is still well-capitalized and has a high liquidity coverage ratio.

From a depositor's perspective, the process is working well as the bank has taken a loss and raised equity to maintain capital ratios. While common equity holders may experience lower valuations, the bank is still worth $6 billion and has a 200 billion asset portfolio.

Even if the bank were to fail, the FDIC has a smooth resolution mechanism that would ensure depositors are made whole. The bank's assets and deposits would be transferred elsewhere, and the majority of the assets are publicly traded securities.

Despite the favorable conditions, some of the world's most prominent venture institutions are urging clients to withdraw their funds from SVB Financial Group. This reaction highlights the importance of public perception and the need for banks to maintain the confidence of depositors and investors.

In conclusion, while the situation with SVB Financial Group is concerning, it is not an isolated incident and is not indicative of a broader crisis.

The banking industry has undergone significant changes over the last 15 years, and banks are now well-capitalized and less likely to take high risks. The situation emphasizes the importance of maintaining public confidence in the banking industry and the need for banks to adapt to changing circumstances.

Now our portfolio in detail…