Why Powell's Dollars Have Generated Inflation and Investment Alternatives to Consider

The expansive monetary policy implemented by the Chairman of the Federal Reserve of the United States, Jerome Powell, has resulted in an increase in inflation

The question of whether the quantity theory of money still holds true is one that has been hotly debated in recent years. This theory states that inflation is a result of too much money chasing too few goods.

However, the outcome of Bernanke's tenure as Fed Chairman in the 2010s suggests that inflation might not be directly related to the amount of money people have, but rather to how eager they are to spend it.

Bernanke's mandate…

vs Powell mandate…

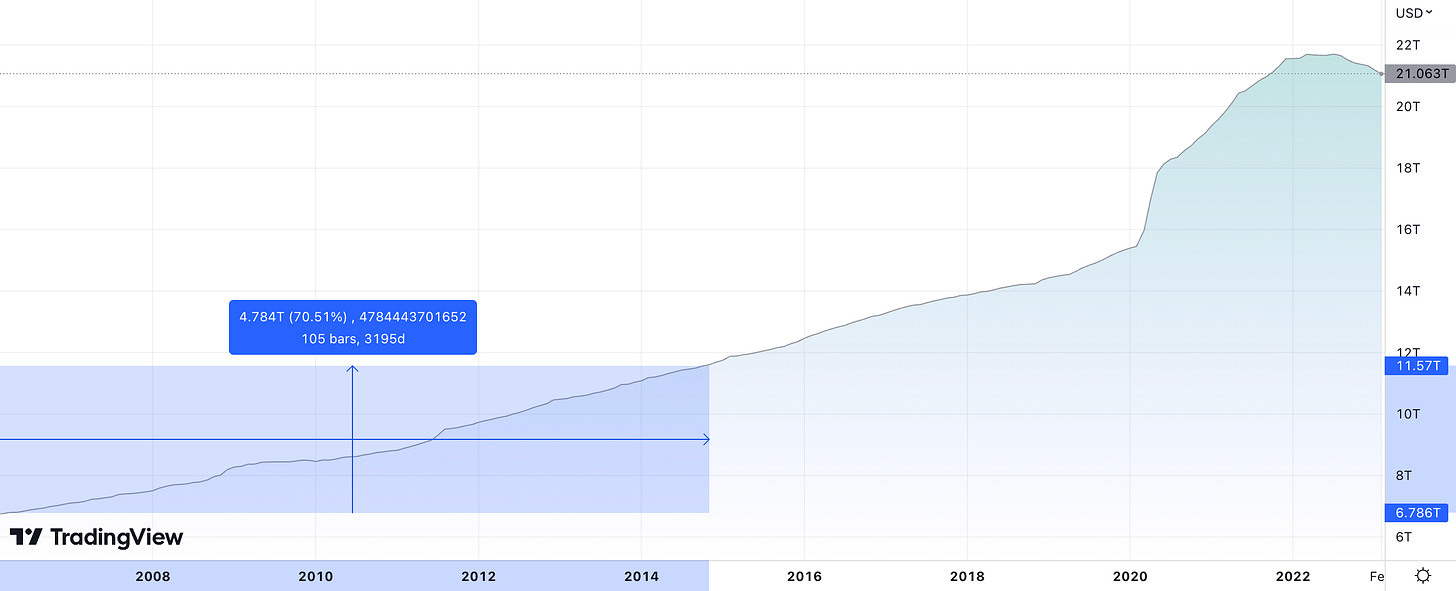

Meanwhile, the Powell dollars printed in response to the COVID-19 pandemic have had a different effect, with inflation surging as demand for goods suddenly increased after supply chain disruptions caused shortages.

To better understand the differences between Powell dollars and Bernanke dollars, let's take a closer look at how inflation works. When there is an excess of money in the economy, people can spend more, leading to higher demand for goods and services. If supply cannot keep up with demand, prices will rise. Conversely, when there is a shortage of money in the economy, people will spend less, leading to lower demand for goods and services. If supply exceeds demand, prices will fall.

During Bernanke's tenure as Fed Chairman, the Fed's balance sheet grew by an average of 22% per year, leading some to believe that inflation would be rampant. However, inflation remained low, and in January of 2015, prices were actually deflating. This suggests that other factors, such as the willingness of consumers to spend, play a significant role in determining the rate of inflation.

In contrast, the Powell dollars printed in response to the COVID-19 pandemic have led to an increase in inflation. With supply chain disruptions causing shortages of goods, Powell's newly printed dollars were chasing them. However, this situation changed when demand for money suddenly decreased, with people eager to spend the money they had saved during the pandemic. This resulted in a surge in demand for goods, leading to inflation.

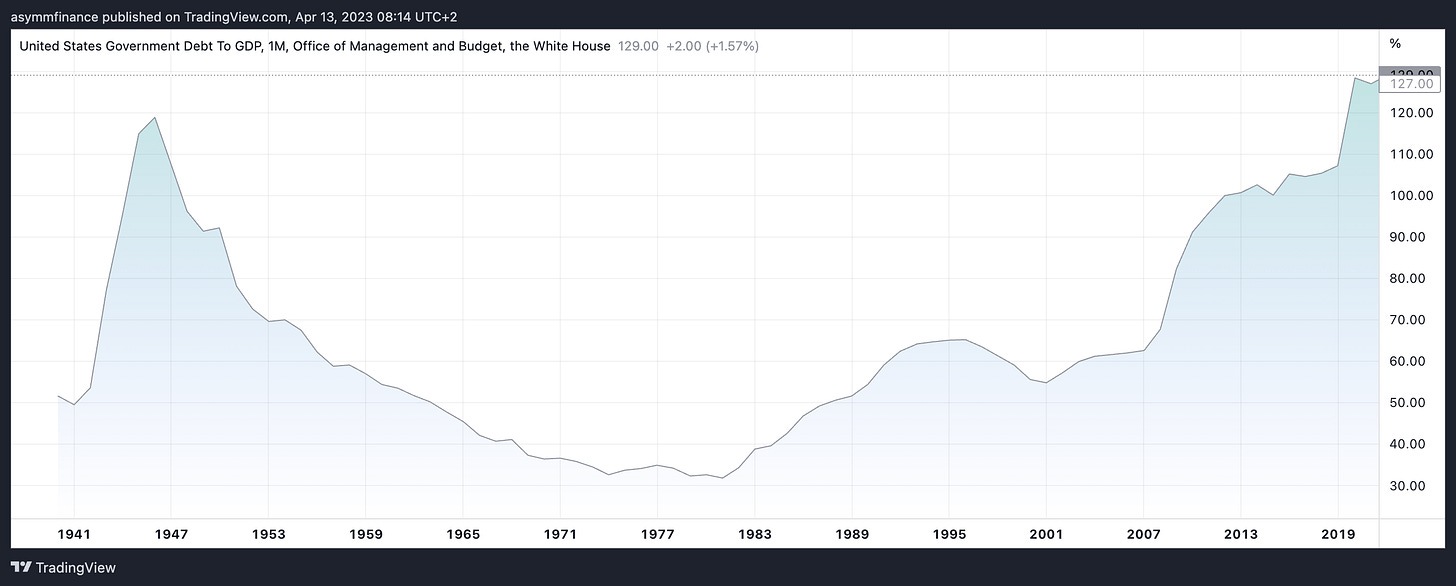

To rebalance supply and demand for money, the Fed has raised interest rates, incentivizing consumers to save their money rather than spend it. Additionally, banks have been hoarding cash due to the fear of bank runs, further increasing the demand for money. This increased demand for money may stabilize inflation in the short term, but the long-term effects of rising federal debt could lead to inflationary pressures in the future.

The US federal debt is currently at 120% of GDP and is projected to exceed 200% in the near future. The only politically plausible solution to this problem is to inflate the currency, which could keep interest rates below inflation for a decade, allowing GDP to rise faster than the federal debt. However, this strategy could lead to a decrease in demand for dollars and a corresponding increase in demand for alternative stores of value, such as bitcoin.

In conclusion, the debate over Powell dollars versus Bernanke dollars highlights the complexity of inflation and monetary policy. While the quantity theory of money provides a straightforward explanation for inflation, the reality is more nuanced. The willingness of consumers to spend money, the availability of goods, and the level of federal debt are all factors that can affect inflation.

As the Fed continues to navigate the challenges of maintaining price stability, policymakers will need to consider these factors carefully to ensure a stable and prosperous economy for all.

Now our >14% YTD asymmetric portfolio…