Why the Rich Love Debt (And You Should Too)

How Debt Can Make You Richer Than Ever Before

As many of you know, I’ve been reading extensively about the power of debt and its origins. One thing is clear to me: debt has existed for over 5,000 years, and it’s arguably one of the most powerful tools ever created. When used wisely, it can help you gain something that money itself cannot buy—time.

The Origins of Debt

Why do I say debt is over 5,000 years old? It’s simple. We often hear that everything started with bartering, but I don’t think that’s entirely true. Do you really believe people went to the baker with two eggs and said, “I’ll trade these for some bread”? Likely not. The baker probably wasn’t interested in what you had to offer at that moment. Instead, they might have told you to bring them something they needed another day.

In fact, clay tablets found in Mesopotamia reveal a system where debts were recorded and later erased once settled. This marks the beginning of a system where trust and obligation became central to economic exchange.

As time went on, kings—and later governments—promised rewards to those who worked for them, creating a dynamic where rulers became indebted to their servants. But let’s be honest: throughout history, those with the most wealth or power were rarely indebted to those with less. It was always the other way around.

This realization has led me to think deeply about how this complex system began. My conclusion? It could only have originated through debt.

Two Types of People: Debtors and Creditors

In today’s world, there are fundamentally two types of people: debtors and creditors.

Who Are the Main Debtors?

Governments

Banks

Corporations

Millionaires

Who Are the Main Creditors?

The middle class

The working class

Debtors have always had an advantage: by being the first to access debt (and therefore money), they’ve gained early access to assets. This allows them to benefit from what’s known as the Cantillon Effect, which describes how those closest to newly created money benefit the most from it.

For example, when a company issues bonds and uses the proceeds to buy assets, those assets are almost always cheaper at the time of purchase than they will be 10 years later for an average individual.

The Tax Advantage of Debt

Another key point is that debt is often tax-free. When you raise money through a bond or take out a mortgage, that money isn’t taxed. However, when you pay interest on that debt, it comes from income that has already been taxed. This creates a significant advantage for debtors.

The takeaway? It’s always better to be as close as possible to the source of money creation.

Why Is Debt More Relevant Now Than Ever?

Consumers currently expect inflation to reach 4.3% within a year. If that’s their expectation, they’re more likely to spend now rather than later, which in turn drives prices higher—a self-fulfilling prophecy of inflation.

While this isn’t a universal rule, inflation often creates winners and losers. Historically, those who benefited most during inflationary periods were:

People who owned assets.

People who held debt.

Why? Because their assets appreciated significantly while their debt became easier to repay over time.

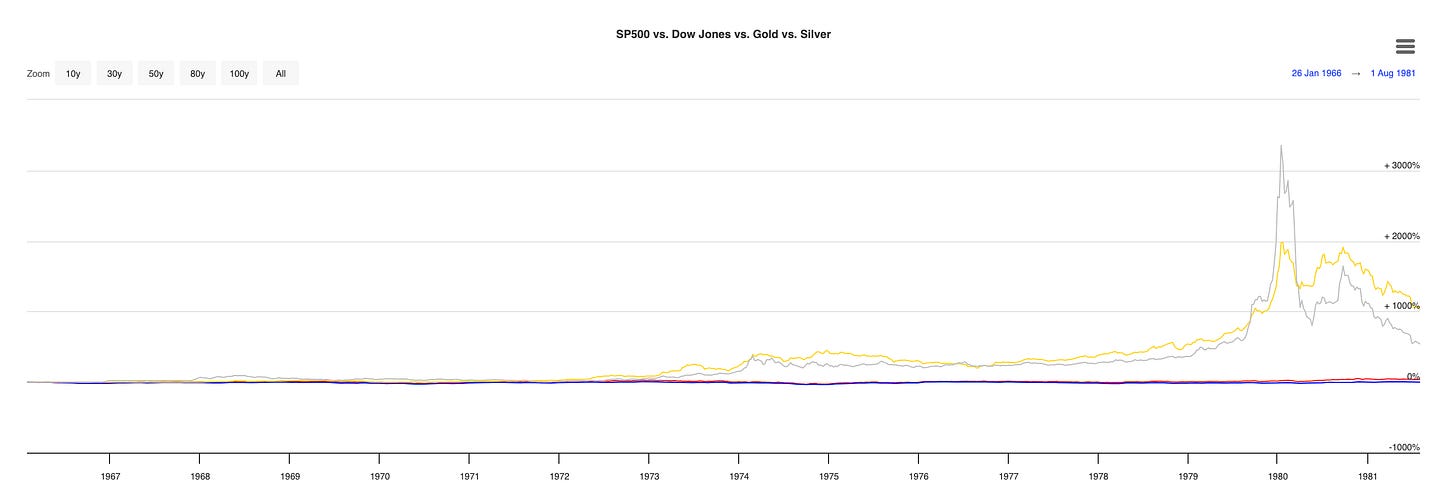

Take the U.S. in the 1970s as an example: during periods of high inflation, those who owned gold, silver, or real estate saw substantial gains in value. Meanwhile, their existing debts effectively shrank in real terms.

Winners and Losers During Inflation

Winners: Those with tangible assets (gold, silver, real estate) and manageable debt.

Losers: Those holding cash or relying solely on wages.

Even stocks struggled during these times due to economic uncertainty but eventually recovered in subsequent years.

Final Advice: Be a Debtor, Not a Creditor

Here’s my advice: become a debtor rather than a creditor. When you’re a creditor (e.g., saving money in a bank), someone else is using your money to generate profits while you receive only a tiny fraction in return.

Many people have been taught to fear debt or view it negatively—and I believe this is a mistake. Debt isn’t inherently bad; it’s simply a tool. When used strategically, it can be your path to financial freedom without having to follow outdated advice like waiting 40 years to achieve it (sorry, Dave Ramsey).

The key is understanding how debt works and using it wisely to position yourself on the winning side of this age-old system.

Now let’s move on to our portfolio.

Updated on 5th March