Why You Should Know When The FED Will Stop Raising Interest Rates

The United States Federal Reserve has a dual legal mandate: to contain prices in the economy and maintain the highest possible employment rate.

Improve your understanding of finance: 85% of people are unaware of what interest rates are. They don't know that it represents the cost of money and directly impacts their financial freedom and indirectly their overall freedom.

What everyone should aspire to is to be free, not having to rely solely on a monthly salary to live.

Having that freedom led us to study the markets and understand how the economy behaves. Believe it or not, the economy is a much more cyclical phenomenon than many think.

Expansion - Peak - Contraction - Trough

This cycle repeats over and over again, without stopping.

One of the factors that most influences the contraction phase is the rise in interest rates. When these rates go up, the economy slows down. Companies no longer want to borrow money for investments, growth stalls, and people refrain from taking loans to buy a house, a car, or go on vacations.

As you know, after the aberration committed in 2020 with the excessive money printing in the markets, there was a period of expansion. This expansion led to a bubble in commodity prices and the cost of living.

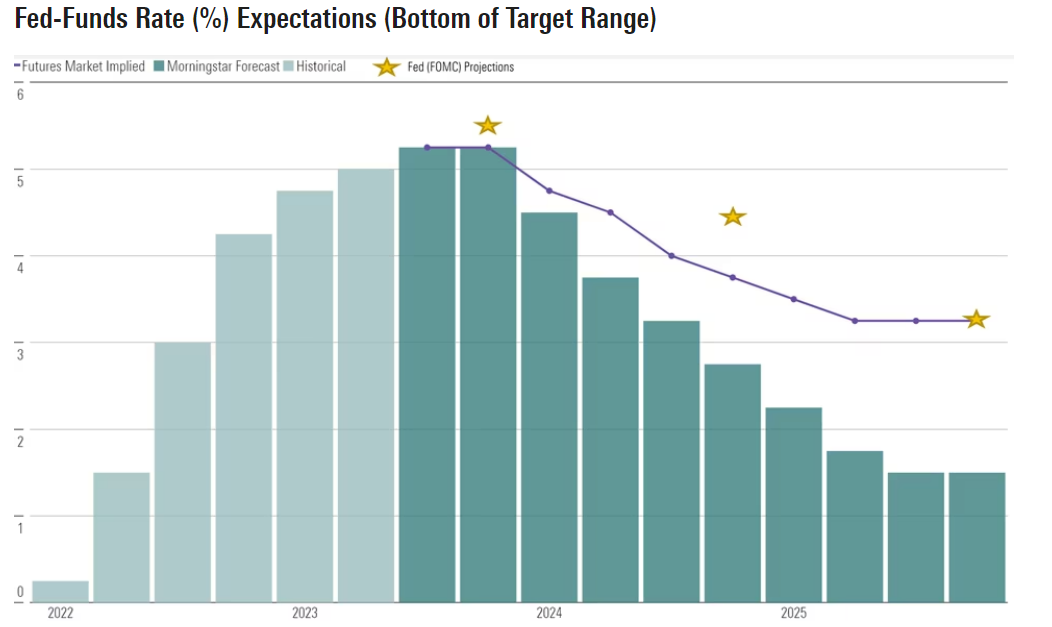

To try to curb this inflation, the FED started raising interest rates. In fact, it was the most aggressive rate hike in history.

Well, what I wanted to tell you today is when these rate increases will stop and why it's important that you know when this will happen.

The first reason is that the economy will suffer initially. As you can see, all rate cuts are followed by a recession.

On the other hand, after a period of rate decreases, we will likely return to an ideal moment to apply for a mortgage or invest directly.

The previous warning was in June 2020; you could apply for an 80% mortgage with 0% interest rates. Today, that same mortgage is worth twice as much.

The United States Federal Reserve has a dual legal mandate: to contain prices in the economy and maintain the highest possible employment rate.

This is tremendously important, and we have already started to see the first part; prices are being contained, and soon we'll see the second part.

People will start to struggle to make ends meet, and that's when the best investors will make a lot of money.

As we already announced, it's most likely to happen in the second half of 2025. Therefore, it's crucial to align your portfolio accordingly.

For those who believed that 2023 was going to be a year of recession, they were mistaken. We already warned about it, and that's why our portfolio has increased by more than 20% this year.

Finally, we want to remind you of the importance of understanding cycles, and if you allow me, I'd like to recommend some reading for this summer.

I hope you're having some enjoyable days of rest.