Why Your Savings Are Worthless

The Real Focus Should Be on Currency Devaluation

I’m genuinely exhausted from saying this repeatedly: if there’s one thing we need to focus on, it’s not valuations, but the devaluation of the currency.

Profits don’t really matter, what truly matters is how much our money is devalued.

Take the U.S. for example—it took the country 220 years to accumulate $12 trillion in debt, yet in just the last four years, that figure has skyrocketed by another $12 trillion.

What previous generations took decades to witness in terms of devaluation, our children have seen it happen before they even set foot in kindergarten.

This is a colossal issue we face, with central banks relentlessly expanding their balance sheets and driving prices higher and higher. As we’ve discussed many times before, this will ultimately lead to social unrest and widening inequalities. Those who are holding tangible, real assets are set to gain massive purchasing power, while those who remain consumers will be left behind.

Fortunately, there are many alternatives to this, which we regularly discuss in the newsletter.

One of the most criticized strategies is the use of debt. However, when used wisely, debt is one of the most powerful tools at your disposal. Not only that, but as we’ve highlighted in previous newsletters, debt can also save you a massive amount in taxes. A little-known secret that I want you to remember: Debt is tax-free.

Governments themselves don’t impose taxes on debt because doing so would prevent them from borrowing. But the snowball effect is already in motion—interest payments on debt are growing exponentially, and within a few years, they’re projected to exceed spending in other budget areas by a significant margin.

Does this mean we’re headed toward the end of the dollar? Not necessarily. In a highly globalized world like the one we live in, it doesn’t appear that any alternative is on the horizon.

Many might point to Bitcoin as the solution, but there’s a major flaw in this theory. If the total supply is limited to 21 million coins, what happens when someone needs to borrow money for something like a home purchase? Where will the interest come from in a zero-sum economy?

Thus, fiat currencies like the dollar (or any slightly inflationary currency) are likely here to stay. The big winners in this scenario will be two groups: 1) those who know how to leverage debt effectively, and 2) those who hold assets with limited supply, like Bitcoin.

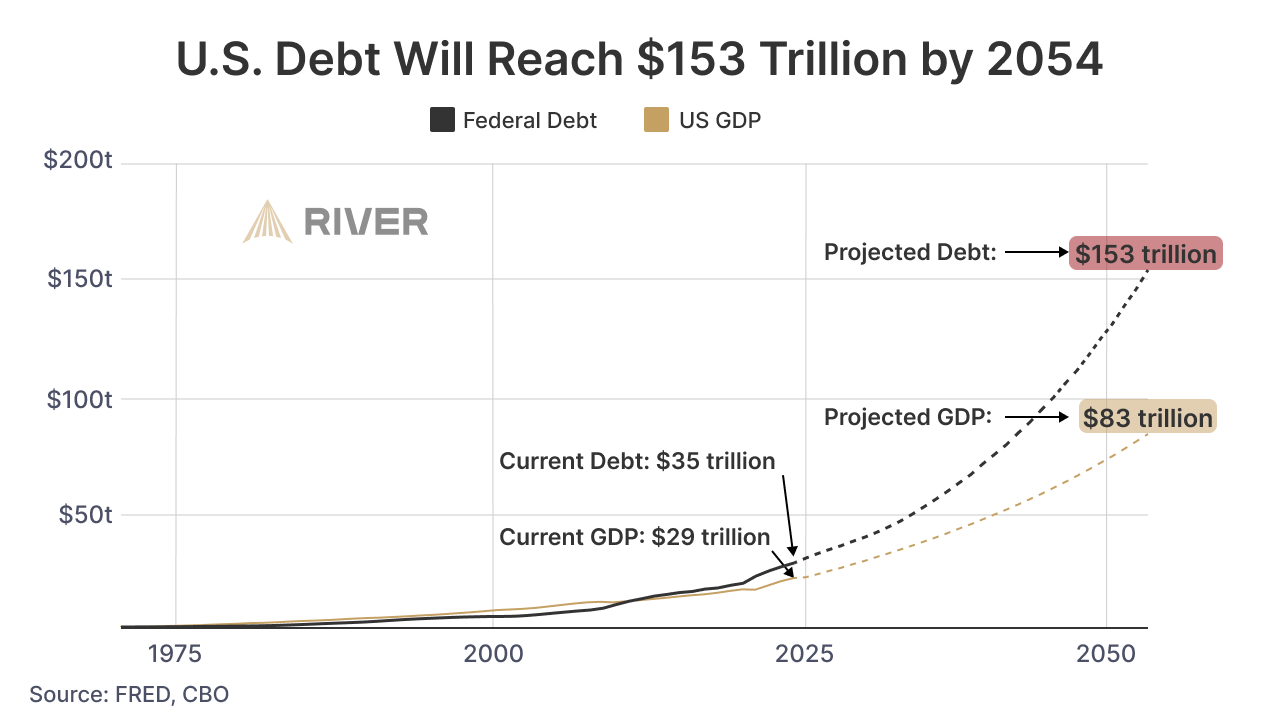

One of the key charts you should really stop and analyze is the following:

According to River, by 2054, it’s projected that U.S. debt will balloon to $153 trillion, while the GDP will only reach $83 trillion. What does this mean? Even more inequality. We’re living in a critical moment where we have the opportunity to take control of our financial future and that of our families.

This is the core issue with money, not the notion of making $3 million profits here or there. The moment you realize that money is just an illusion—a promise—you’ll also realize that all the so-called "gurus" who preach "DON’T GET INTO DEBT" don’t truly understand that the money in your bank account is someone else’s debt. So why shouldn’t you be the one benefiting from that debt instead?

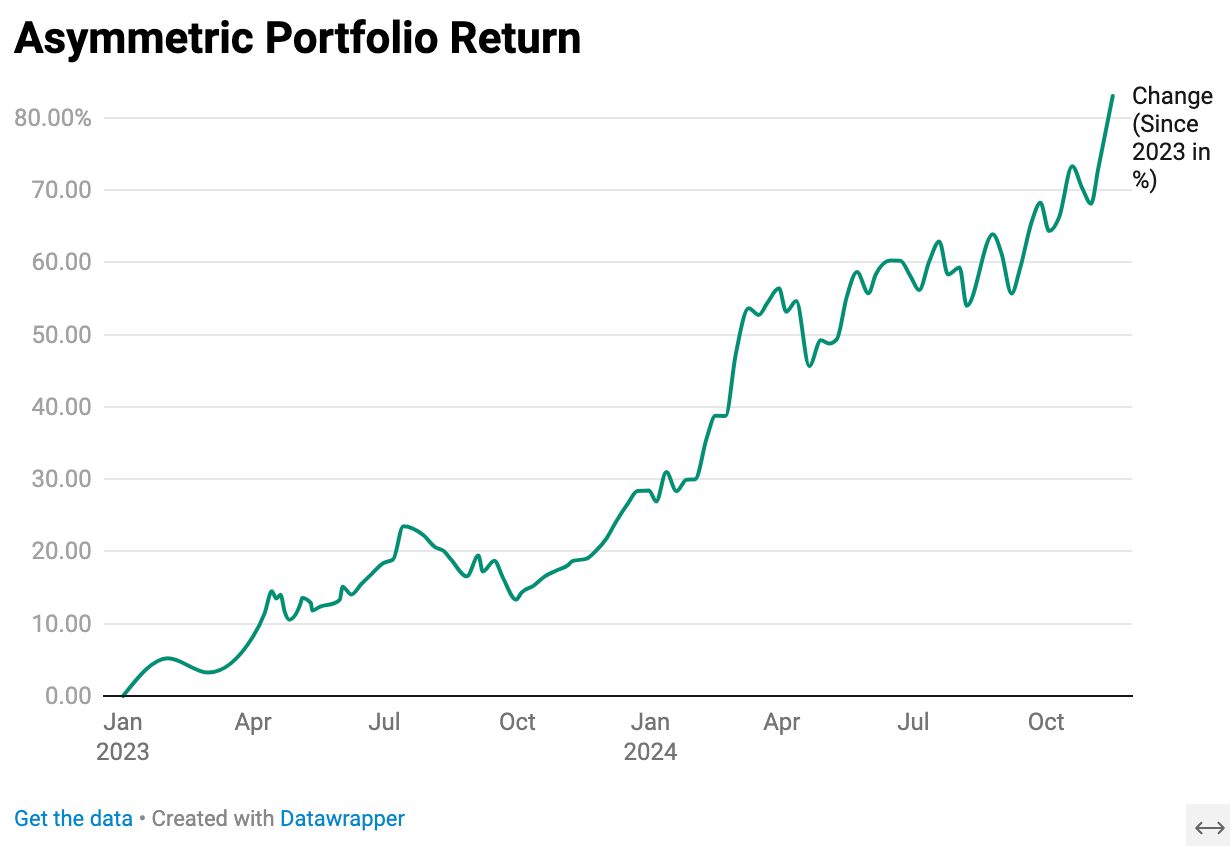

Now our asymmetric Portfolio: