Will Trump’s ERS Make Americans Richer or Poorer?

What Happens If the U.S. Replaces Income Tax with Tariffs?

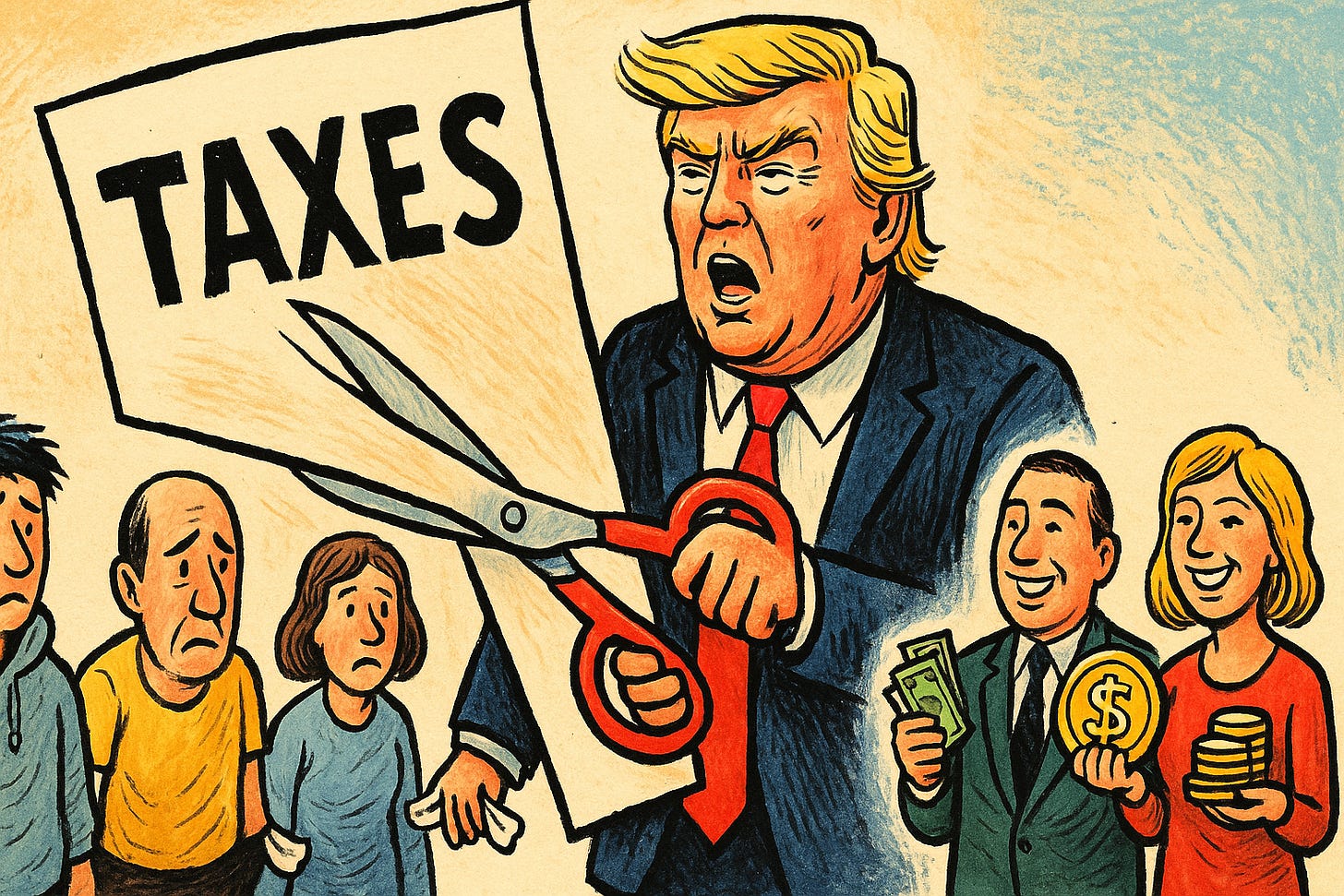

Imagine waking up one day and discovering that your paycheck is no longer subject to income tax. The money that today goes straight to the government would stay in your pocket. That is exactly what Donald Trump is putting on the table: replacing the IRS with a new body called the ERS, External Revenue Service, which would stop taxing citizens directly and instead fund the government through tariffs on imports. A radical shift. Not a technical adjustment, but a complete rewrite of the U.S. tax system.

The consequences of such a move would be profound. For the U.S. For global trade. For our portfolios. And it’s worth understanding them before falling for the illusion that eliminating income tax is a free lunch.

Trump’s proposal doesn’t come out of nowhere. During his first term he already imposed aggressive tariffs on China and other countries. Now he talks about formalizing it as a full strategy: tariffs of 10 to 20% on all imports, and up to 60% on Chinese goods. The logic is simple: instead of “punishing” the American worker, make the foreign producer pay to access the market.

Historically, this is not new. Before 1913, when the IRS was created, most federal revenue came from tariffs. At some points in the 19th century, they represented over 90% of collections. So yes, the U.S. once functioned under a similar system. But the world was different. The U.S. was a net exporter, and global trade was a smaller part of domestic life. Today, the U.S. massively depends on imports from clothing to tech components. Raising tariffs now hits consumers directly.

Here lies the first paradox. Eliminating income tax could increase disposable income, but the prices of almost everything people buy would rise. Not just electronics and cars. Also clothing, shoes, tools, household goods. Imported inflation. And while some argue this would incentivize local production, the reality is the U.S. industrial base cannot be rebuilt overnight.

There’s another layer. The federal deficit remains gigantic over two trillion dollars per year. Even with a 20% tariff on all imported goods, collections would barely cover around 15% of current government revenue. Tariffs don’t replace income tax, they just cover a slice. The rest still requires internal taxation or more debt. And as we know, debt is Washington’s true funding machine.

Some countries live without income tax. Dubai, Monaco, the Bahamas. Their trick? Attracting capital with competitive tax regimes, then funding the state with low corporate taxes or indirect consumption taxes like VAT. But the U.S. is not a desert tax haven. It is the issuer of the global reserve currency and the largest consumer market on earth. Its fiscal structure responds to imperial logic. Copying Dubai is not so simple.