You Missed This Crash Signal (I Didn’t)

This Is Where Asymmetric Gains Are Made

On May 6th, the S&P 500 ended its 9-day winning streak, the longest since 2004. For most, it was just a market curiosity. For others, an opportunity.

At Asymmetric Finance, we saw it coming and acted: we exited key positions with a 300% return in just one week. Don’t take our word for it, check the receipts:

300% Gains in a Week – My Asymmetric Playbook

Urgent: Blood Begins to Spill in the Markets

It wasn’t luck.

It was strategic positioning.

Events like this are reminders that wealth isn’t built by guessing the future, but by placing chips where the potential upside far outweighs the downside. That’s the core of asymmetric thinking.

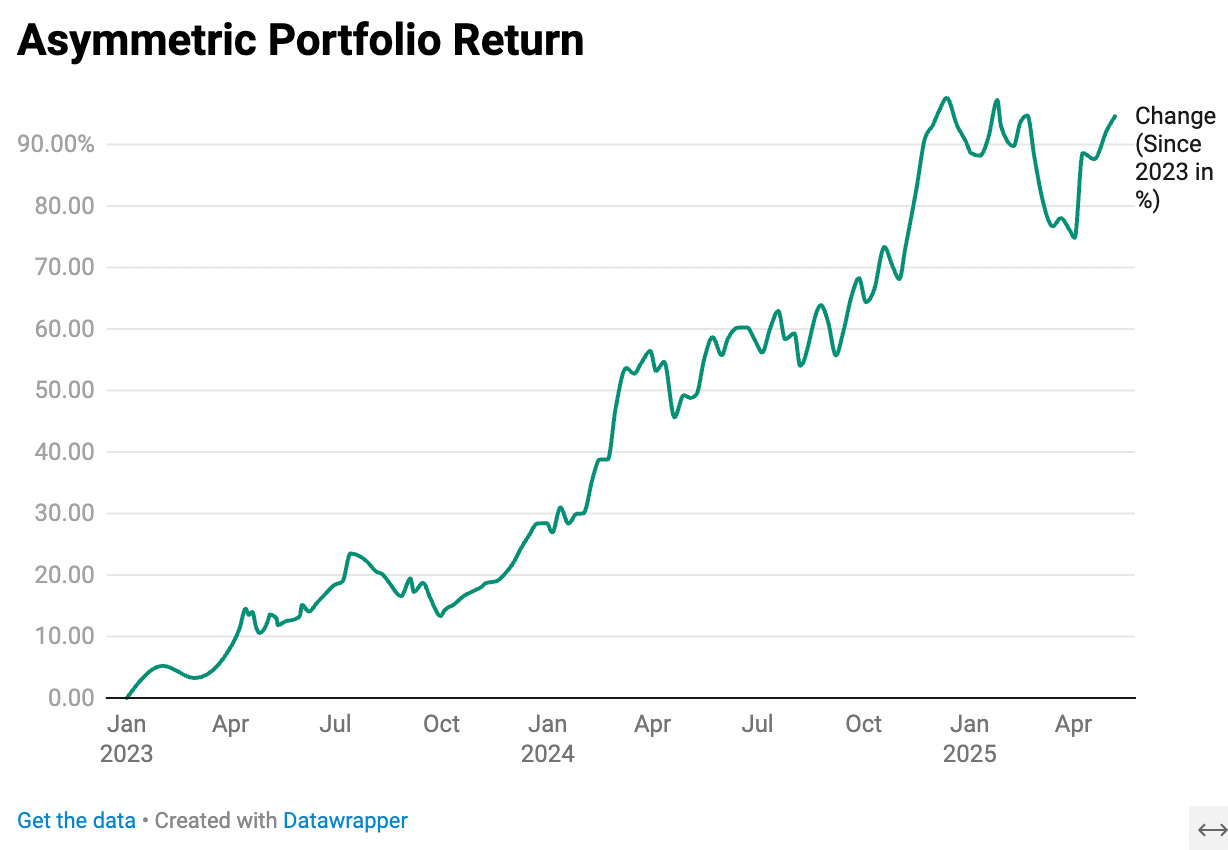

Since late 2023, markets have staged a so-called miraculous recovery. The “soft landing” narrative, rate cut hopes, and an AI-fueled mania have pushed the S&P 500 higher while retail investors rushed back in.

But here’s an uncomfortable truth: the best opportunities don’t show up when markets are melting up. They emerge when cracks appear in the story and nobody wants to look under the rug. What happened in April with Trump’s tariffs was exactly that, an unexpected pause that exposed hidden fragility.

And if you’re ready, that fragility becomes your edge.

There are three specific ways to position yourself to capture this type of asymmetric opportunity:

1. Stop following the narrative. Start following the data.

When everything looks overpriced, maybe it’s time to buy OTM insurance. People tend to buy protection after their house is already on fire.

When everyone’s on one side of the boat, any wave can flip it.

Result: +300% return in five days.

You don’t need to trade options to apply this principle. Just watch what the real movers in the market are doing and act accordingly.

2. Invest in drawdowns, not in all-time highs.

Most investors buy when everything feels good. But when everything feels good, it's already priced in. You’re paying a premium to join the party late.

If you buy at those moments, don’t expect to outperform the index.

We’ve said it before: cash is a position. And often, a damn good one. Warren Buffett is sitting on record-high levels of liquidity. That cash is earning him over 4% annually in safe yields. The risk-reward is ridiculously asymmetric.

3. Use leverage, but do it smart.

We’ve talked about this a lot: the only real path to serious wealth is through debt. Debt can kill you. But it can also make you rich.

Used prudently, it’s a wealth accelerant.

Look at COVID. Look at 2009. Rates dropped to zero or even negative in some currencies. That was the exact time for strategic leverage. Imagine combining all of this: HEDGE + CASH + a 20% DROP + smart leverage. That’s where real money is made in markets.

It’s more a mindset than a tactic. A mindset inherent to millionaires.

So why does all this matter?

Because real results don’t come from one lucky move. They come from repeating the same pattern with discipline.

Warren Buffett didn’t get rich by calling market bottoms. He got rich buying quality assets when nobody wanted them, and never selling.

John Templeton bought Japanese stocks when everyone thought Japan was dead.

Ray Dalio shorted the debt bubble before 2008.

Howard Marks wrote that the best opportunities are born from extreme fear.

What do they all have in common? They didn’t try to predict the future. They prepared for when the present broke down.

If today you decide to look at markets through an asymmetric lens, and if you repeat these three strategies consistently, you’ll build a system that doesn’t depend on emotions or headlines. It depends on you. And that’s the best thing you can do for your financial freedom.

Because waiting for the perfect moment… is the perfect recipe to do nothing.

Next time you see a headline like “S&P 500 breaks new records,” don’t just scroll past it. Ask yourself: What is the majority doing? Where are the hidden signals? Is there an opportunity no one’s seeing?

Remember Charlie Munger’s words:

“The key to intelligent investing is not being right more often, it’s losing less when you’re wrong and gaining big when you’re right.”

That’s the game. Not perfection, positioning.

You can start today.

Today, when things are unclear.

Today, when the signals are mixed.

Today, when no one claps for buying with a cool head.

Because when the next drop hits, you won’t panic.

You’ll already have a plan.

Portfolio updated on 7th May