Your Salary Is Failing You

Here’s What to Do Instead

According to the Bank of Spain, only 19% of people understand the term inflation. It may seem like just another statistic you hear daily, but it’s not. How is it possible that something so obvious and that is making you poorer every day is not understood?

This doesn’t mean knowing the difference between CPI (Consumer Price Index) and real inflation (also very important); it means understanding simple terms like knowing that prices rise due to monetary printing to repay debt.

Inflation causes us to work with different orders of monetary magnitude over time.

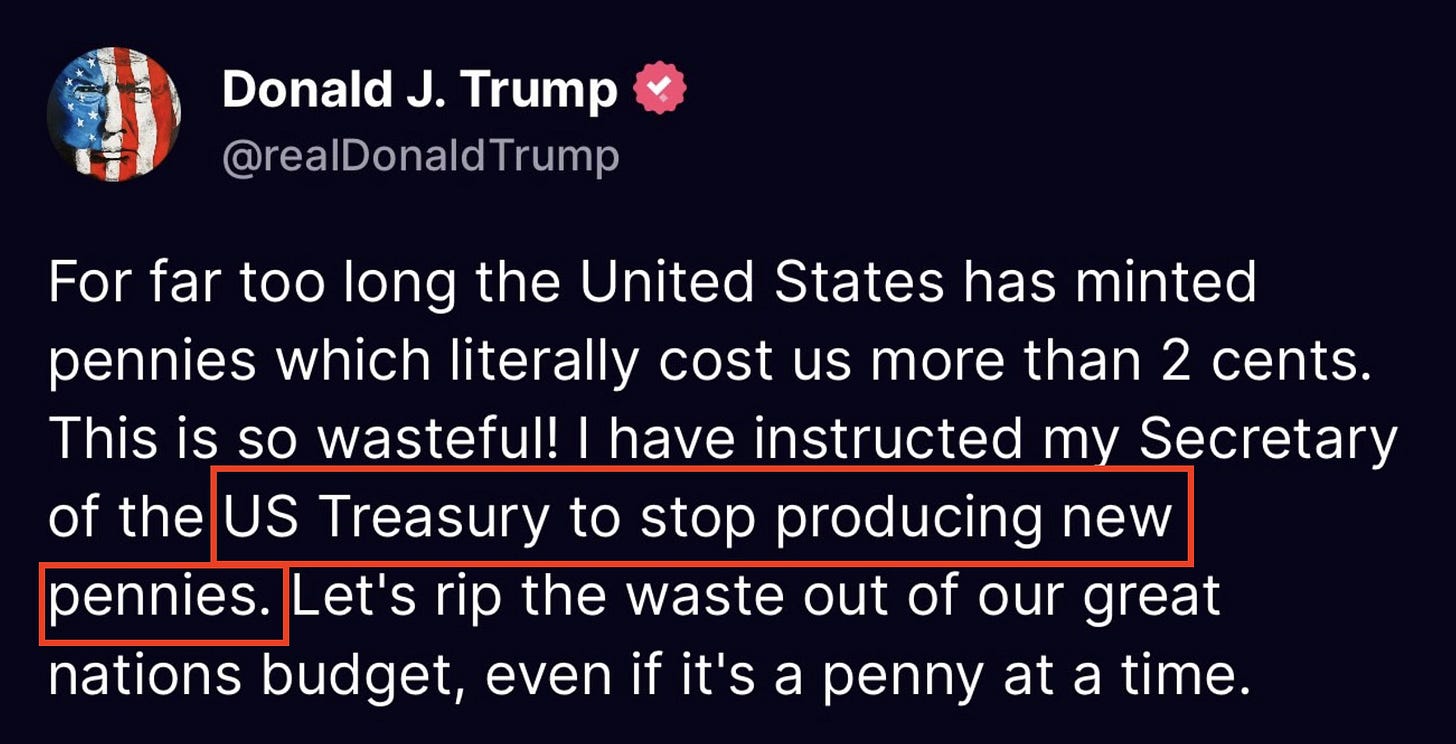

One of the most curious actions taken during the Trump administration was eliminating penny coins.

Regardless of the fact that each penny costs three pennies to produce, this signifies that the order of magnitude of things will change. What used to cost 100.38 will gradually cost 100.4.

Those who have traveled know that in underdeveloped countries, one dollar can be exchanged for 1,000 units of the local currency.

This means that when you buy a bath gel, it doesn’t cost 525.45 but rather 600.

This shows how little value money has. I already discussed in an article how in Indonesia, the exchange rate went from 4 to 1 to 17,000 to 1.

This makes me think a lot about how little importance money has and how much we value it. Money is simply a magnitude that changes over time, sometimes decreasing but mostly increasing. We have more and more money, and this will continue forever.

Hence the great importance of owning finite assets.

This leads us to reflect on the importance of protecting our purchasing power against inflation. While money loses value over time, finite assets like gold, real estate, or Bitcoin emerge as the best alternatives for preserving wealth. These assets cannot be created out of thin air, making them more resistant to depreciation than fiat money.

Who loses in this game?

Those who hold currency.

Those who don’t have (manageable) debt.

Those who rely on a fixed income (civil servants, pensioners, salaried workers, etc.).

Perhaps it’s a very recurring lesson, something very obvious, but I strongly believe in owning finite assets and, most importantly, never selling them. It’s not just my opinion; one of the richest men in the world says so.

Finally, and perhaps this is all you should take away from this: A widely cited study on the importance of asset allocation versus market timing by Brinson, Hood, and Beebower (1986) concluded that 91.5% of a portfolio’s performance is determined by asset allocation, while security selection contributes only 4.6%, and market timing just 1.8%. This demonstrates that strategic asset distribution has a much greater impact on long-term results than trying to predict market movements.

Asymmetric Finance is precisely about owning uncorrelated assets and holding them over time. It’s not about finding the next Nvidia or the best cryptocurrency but about buying good finite assets and keeping them.

Now, we’ll show you our portfolio in detail.