You're Going to Be Out of a Job, Stu**d

Navigating the Future: A Reflection on Asimov's Legacy and Our Automated World

Over two decades ago, as a young, impressionable individual, I was introduced to the works of Isaac Asimov. An American professor and writer, born in 1920, Asimov's foresight painted a future drastically different from his era. His world was one where robots, a term he himself coined, were integral, possessing an intelligence far beyond human comprehension.

Asimov didn't just predict the future; he shaped our understanding of it. His vision, wherein robots dominated the landscape, was not mere science fiction but a profound prediction of the impact of automation on society and the workforce.

The Asimov Influence and its Real-World Implications

Elon Musk, a prominent figure in modern technology and space exploration, grew up reading Asimov’s books. The influence is evident in Musk's ventures, which consistently push the boundaries of what's possible, always staying a step ahead in innovation. Asimov's writings are not just stories; they are blueprints of a future where technology reshapes every aspect of life.

The Automation Impact on Productivity and Workers

The rise of robots has led to an unparalleled increase in productivity. However, this boon has not translated into widespread prosperity for the workforce. A graph depicting this trend would show a stark contrast between soaring productivity and stagnant wages:

This disparity points to a troubling trend where the financial benefits of automation accrue to businesses and the ultra-wealthy, exacerbating wealth inequality. Historical data on wealth distribution confirms this, showing the wealth gap at its widest in recent history:

The Inevitable March of Automation Across Industries

The automation revolution is not confined to manufacturing or menial tasks. Its reach extends to all sectors, including white-collar jobs. Martin Ford's "Rise of the Robots" encapsulates this trend, illustrating how automation is reshaping the job market.

Two critical conclusions emerge from this shift:

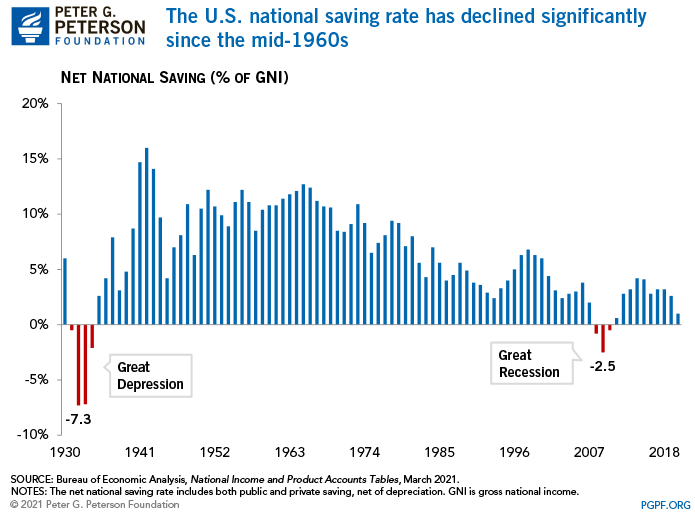

Investment as a Necessity: In a world of diminishing job security, personal investment becomes essential. With savings at historically low levels, many are ill-equipped to face a future without a steady income. A relevant graph here would highlight the alarming state of personal savings:

Bracing for Economic Hardships: The ballooning national debts, coupled with inadequate personal savings, foretell a grim scenario. In the event of a major recession, consumer spending could plummet, triggering a cascading economic crisis.

The Job Market Transformation and Its Challenges

Since the advent of workplace automation, the time it takes for an unemployed individual to find new work has increased significantly. This trend suggests a new reality: losing a job to automation likely means it's gone for good.

Final Thoughts: Investment Strategy in an Automated Age

Regardless of your investment strategy, it's imperative to allocate a substantial portion to low-risk financial assets. We are on the cusp of an era where many jobs will be automated. This seismic shift will disrupt markets, creating both challenges and opportunities for investment.

In this new economic landscape, the true beneficiaries are those who invest wisely. Entrepreneurs and investors stand to gain the most, navigating through the upheavals brought about by automation.