Weekly Paid Newsletter 02/20/2022

How To Be A Completely Moron And Make A Lot Of Money

This coming week is going to be hot, we already have the major cryptocurrencies falling hard on Sunday and surely these falls will be reflected in the indices this week.

The market is running out of liquidity, and this is without a doubt the most dangerous thing that can happen for investors. When you try to sell your falling positions and you can't get out of them...

This fall in the crypto world is due to the fact that it seems that this March there will be a rate hike.

Do you know what this means?

Noise in the markets --> Highly leveraged markets --> Many investors start to jump portfolio margins --> There is more noise --> Implied volatility rises --> Normal volatility rises --> Investors start to lose money --> We continue to make money --> Investors sell their positions with losses because the great apocalypse is coming --> We make much more money --> Powell speaks --> Everything returns to normal.

We don't know if it will be like this or not, but if our strategy is having success, it is for a reason. Maybe because investors are seeing the wolf's ears, or maybe because we are 0% YTD, while the indices:

*DOW: -6.2% ❌

*S&P 500: -8.7% ❌

*NASDAQ: -13.4% ❌

*RUSSELL 2000: -10.5% ❌

Now I'm going to tell you Why does the pizza maker has an iPhone when he earns $10/hour?

Some time ago, I discovered that there are two types of investors: those who make a lot of money and those who think they will make a lot of money. There are probably more types, but you can perfectly well include any investor in one of these two groups.

Human beings are local animals interested in what will happen today and, at most, tomorrow. This short-termism leads us to have immediate stimuli. We are very fond of "earn 100 dollars a day", "lose 10kg with this diet in one month", etc. It's sad, but that's how we are.

We try to find the exact and precise formula and, for that, we do what the herd dictates. We spend hours and hours analyzing companies until 3 in the morning to conclude the "target growth" of a company and create highly developed reports so that our bosses or VPs get promoted and get a good bonus for their work.

These people buy shares of companies in which they invest a lot of money, they rely on the report to justify their choice, and if possible that these companies grow soon before they get the bonus.

In this way, they justify all their hours with a complex report and then invest their own bonus in a passive fund, like my friend.

People are idiots.

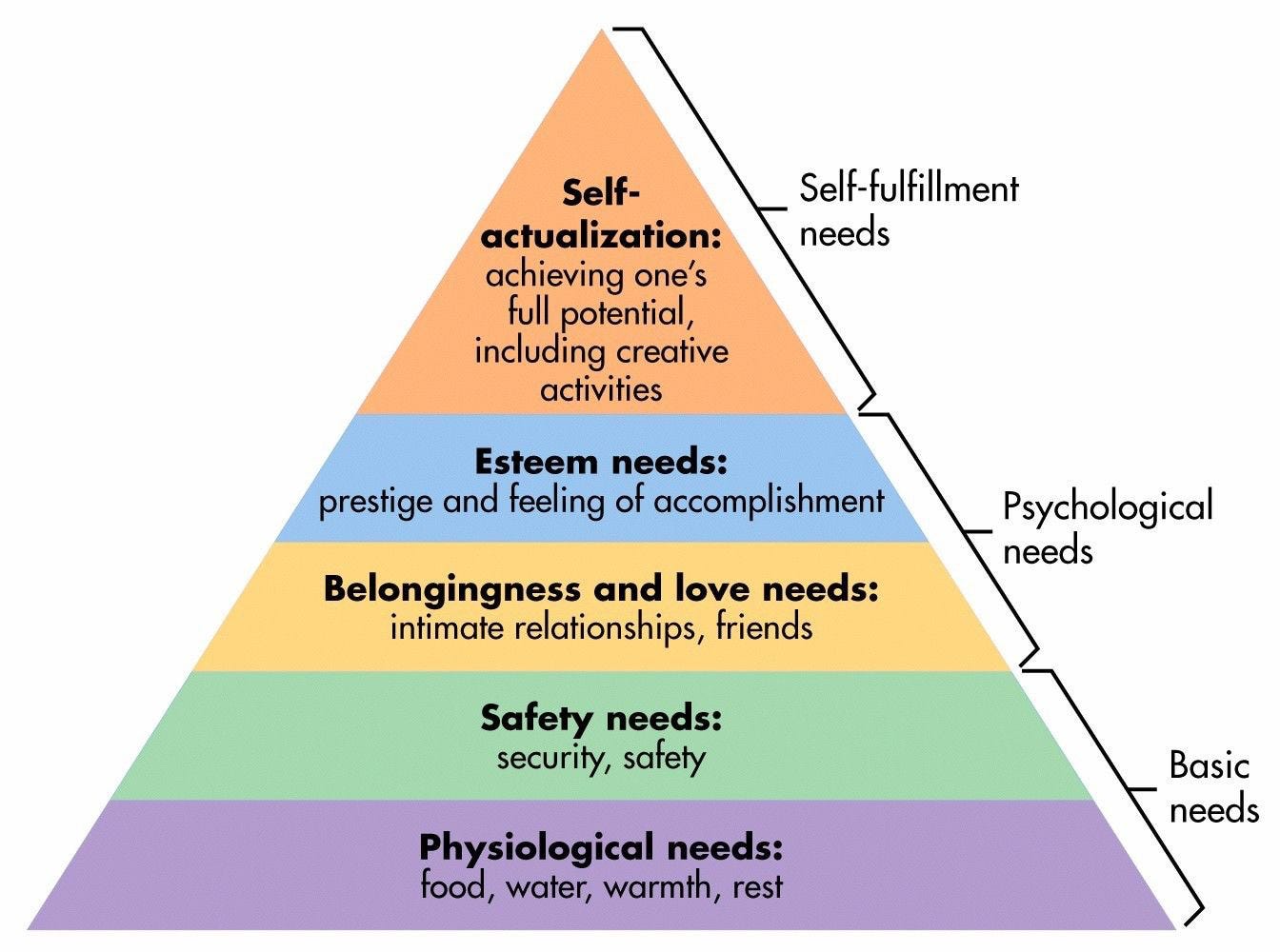

Why do people do this? I'll explain it to you with Maslow's pyramid.

These type of people try to get to the top of the pyramid without going through the bottom. It's like trying to drive a space rocket on your first day as an astronaut.

They want to fulfill the needs at the top of the pyramid, leaving aside many of the needs below. It's about getting others to recognize us for what we do.

For others to notice this, they have to create a LinkedIn profile and take on complex positions in large Private Equity firms.

It's funny because then comes a 12-year-old kid who buys an NFT and earns the same money that Wall Street analyst has gained in just a few hours. Or a YouTuber for a few hours of recording a day, but we'll leave that for another day.

Unfortunately, there are a lot of people who want to be in this group before being in the rest, maybe they don't work in a PE, and perhaps they don't work on Wall Street. But this profile exists in every city in the world.

A clear example is the pizza delivery guy who has an iPhone. He sells his hour at $10 to buy a $1300 phone. Why? To cover the top of the pyramid.

I decided a long time ago not to be a complete idiot and to opt for an investment method that allows me to live upside down.

To have a portfolio that allows me to have minimal risk and to fulfill the stages of Maslow's pyramid in the established sense, from the bottom to the top.

The only way to achieve this is with an asymmetric portfolio. There are many possibilities of asset allocations within this portfolio, but the bottom line is the following one.