Are You Tired of Hearing Bearish Gurus Predicting the Doom of the Market?

Here are some reasons to be optimistic about the future market

In the past few weeks, I have received numerous inquiries about the current market situation. There is extreme pessimism in the financial world, but there is no reason to succumb to that mindset. It is true that if the Federal Reserve (Fed) does not take action or if the measures taken are insufficient, we may potentially enter a recession. However, this does not mean that if the Fed implements normal or expected actions, the market will necessarily exhibit a bullish behavior.

Today, I want to discuss what could happen if the market follows patterns from previous cycles and why you should stop paying attention to bearish experts.

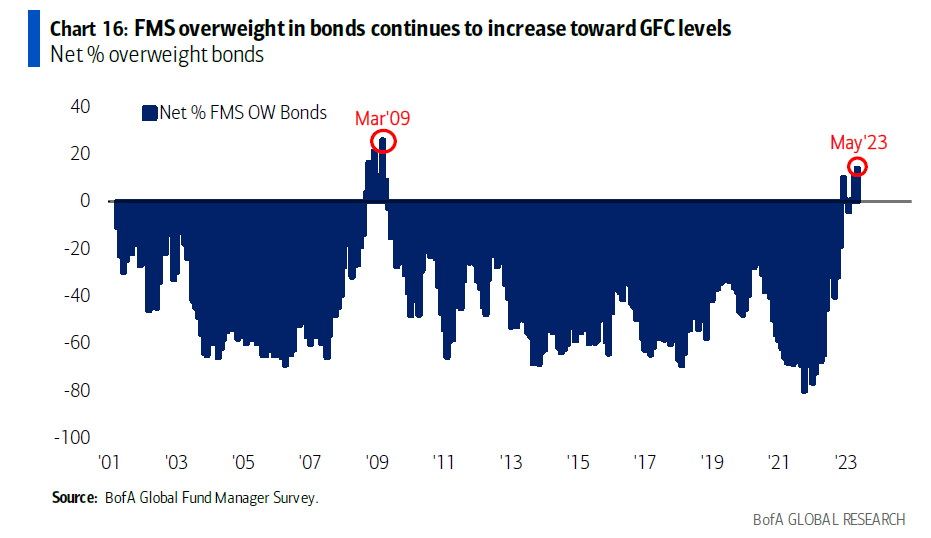

The first reason why you should stop listening to pessimists is that they thrive on selling fear without having solid foundations to support it. Furthermore, the fact that the market is more pessimistic than ever indicates that it has already factored in those circumstances, which suggests that they are less likely to materialize.

Remember that I have told you on multiple occasions that the market always seeks to inflict the most harm on the greatest number of people. Do not forget that.

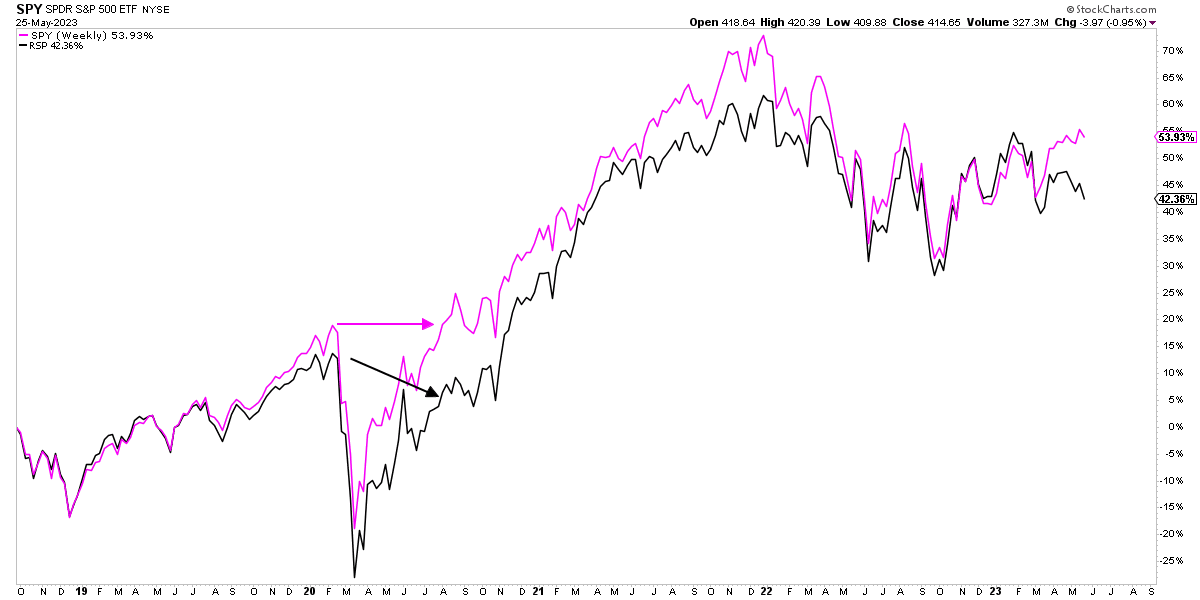

On the other hand, one of the indicators most cited by the bears is market breadth. What does this mean? It refers to the divergence among the companies that make up an index and how they correlate with each other.

As of the close of last Thursday, the ETF "SPY," which tracks the S&P 500, recorded a gain of 8.84% year-to-date. Not bad for the first five months of a year in which most analysts expected a bearish market. However, the ETF "RSP," which replicates the components of the S&P 500 but assigns equal weight to each stock regardless of its market capitalization, showed a loss of 0.44%. This represents one of the largest divergences in recent decades.

Pessimists highlight this current divergence because it reminds them of what happened in October 2007 when the S&P 500 (SPY) reached a new high while the equal-weighted index (RSP) failed to do so, preceding the major bear market of 2008.

It is true that there is legitimate fear in this regard, but as often happens, correlation does not imply causation, and I firmly believe that will be the case this time as well. During the pandemic, there was also a significant divergence between market breadth and the overall market, but that did not mean that the market was bearish.

Now, why do these divergences occur? The answer is simple. We are in extreme market conditions characterized by the fastest interest rate hikes in history. As you know, the Fed has played with liquidity like a child plays with a yo-yo. This has led the market to believe that large-cap companies such as Google, Microsoft, and others will not face any problems with the interest rate hikes; in other words, they will be agnostic to Powell's actions. However, the market believes that many other companies will start encountering difficulties in paying their debts and loans due to the rate hikes.